August is traditionally one of the most active export months in the first half of the agricultural year.

July 2020 was not very active in the export market, the rate of shipments began to accelerate only in the second half of the month, when export prices rose, the ruble began to weaken, and the supply of grain from the new harvest increased.

Agricultural producers are holding back the acceleration, expecting that against the background of the expected drop in yields in the EU and Ukraine, prices will continue to rise.

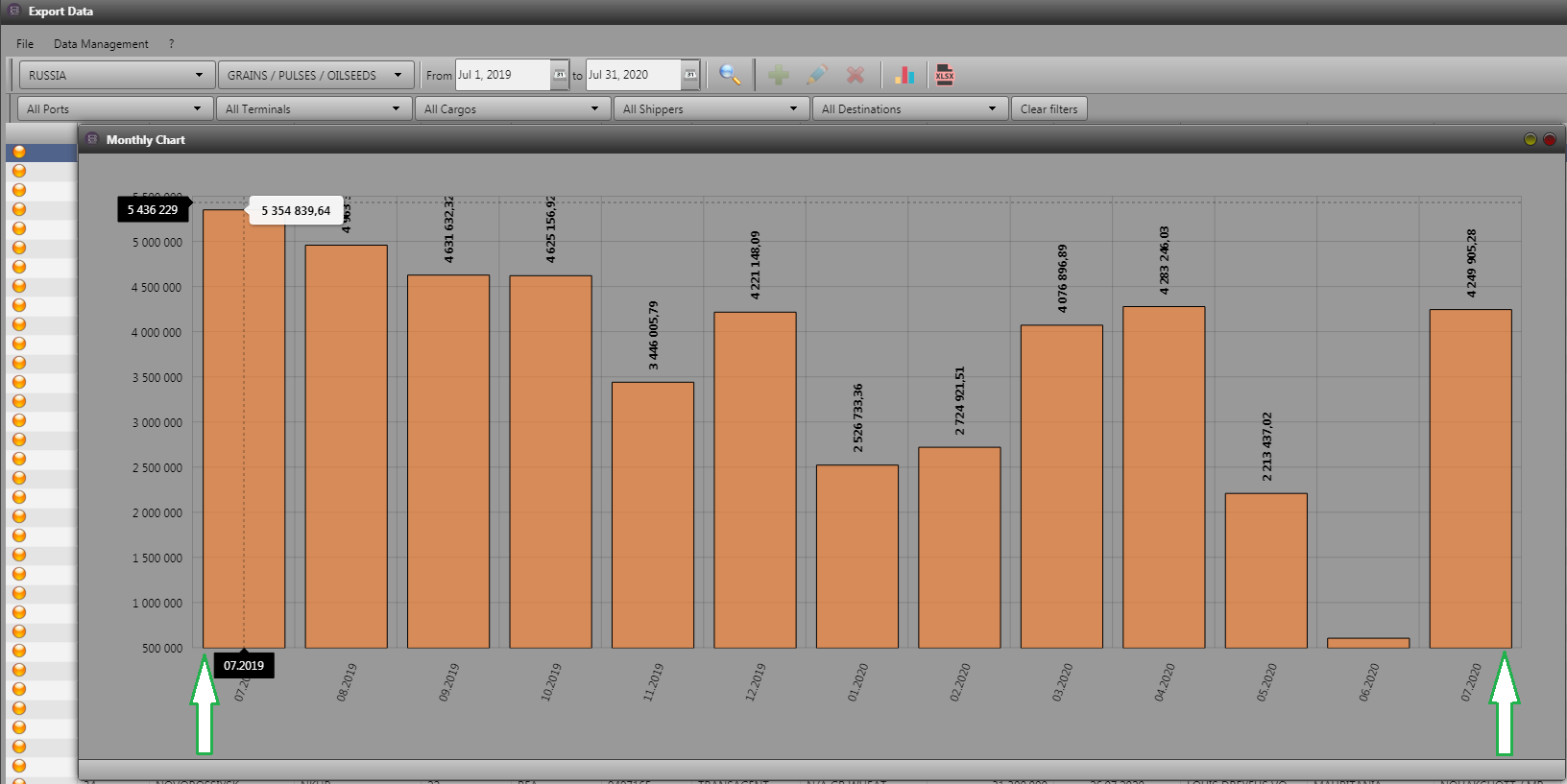

According to the latest updated data from the platform Logistic OS in July 2020, in total, 4,249.9 thousand tons were shipped .

For the same period last year, this figure was 5 354.8 thousand tons .

Thus, the drop in exports amounted to about 20% .

This is primarily due to the late harvest in the south, respectively, shipments also began later.

The supply at the start of the harvesting company was also reduced by the drop in yield in the Stavropol and Krasnodar regions, amounting to about 10%.

Some experts predict a decrease in shipments in August 2020 by about 5%, some agree that there will be no decline, but there will be no growth either.

In August 2019, Russia exported grains abroad in the amount of 4,963 thousand tons .

Given the drop in gross grain yields in the EU and Ukraine, the demand for Russian wheat remains stable.

Customers not frequent for Russian manufacturers, such as, for example, Brazil and Pakistan , began to join traditional buyers.

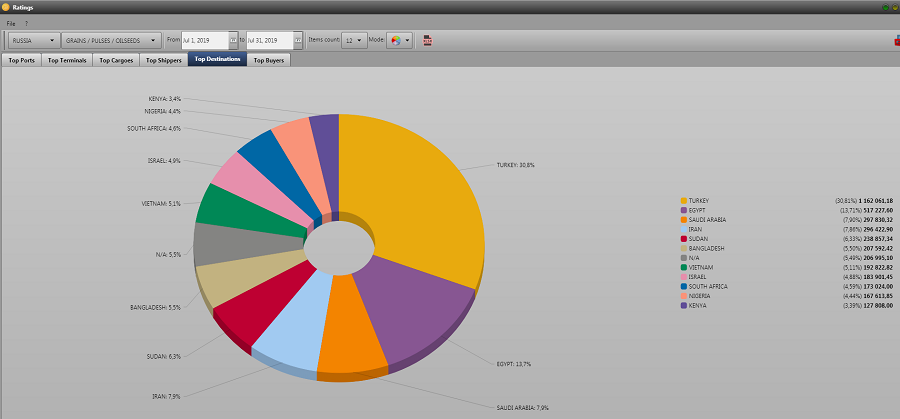

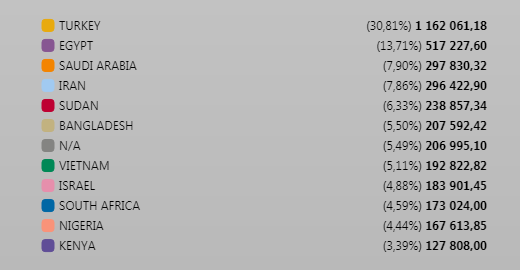

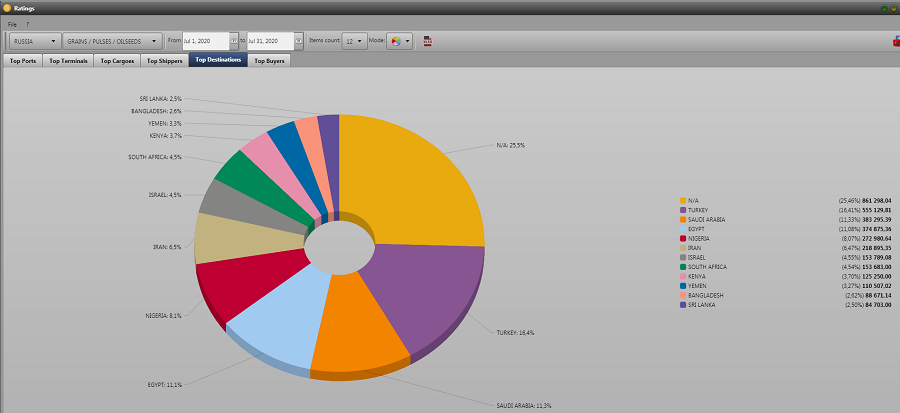

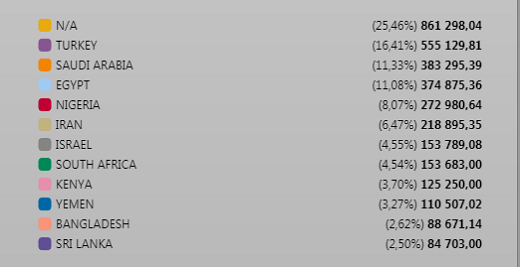

In July 2020, as in 2019, according to the Logistic OS platform, Turkey remains the main importer. (Data on ratings of ports, buyers, cargo, etc. are located in the attachment ratings )

But the rest of the list has undergone some changes.

2019 year

2020 year

Egypt was ousted from the second place by Saudi Arabia, Nigeria significantly increased purchases.

Reduced purchases by Iran, Israel, Bangladesh. Sudan and Vietnam are out of the top 10.

Most likely, the export of grain will begin to accelerate significantly in the first half of the agricultural year, because traders will try to export the maximum volumes, having an incomprehensible situation with the quota.

At the same time, even selling wheat at a reduced price.

And also in the second half of the agricultural year, the southern hemisphere will join the competition, where the forecasts for the harvest are stably optimistic.