The country plans to raise crop imports this season to a seven-year high, doubling in just two years.

Like many states, the Celestial Empire is strengthening its food potential.

It would seem that in this situation, Russia, which will definitely harvest a record grain harvest, could claim to expand its partnership with China and occupy a more comfortable and larger niche in supplies to this country.

But, the problem is that the PRC buys Russian wheat only from certain regions: the Far East and Siberia, because it believes that in other regions the culture can be infected with ergot fungi.

Chinese importers take the quality of grain very seriously and only buy it after a thorough check.

And during the pandemic it was simply impossible to do this.

Although, it should be noted that all consignments of wheat exported from Russia to China are thoroughly tested and meet quality standards.

Last season, the main suppliers of wheat to China were France, Canada and Australia.

This year, China plans to sign contracts with high-yielding Australia and France.

And, of course, the USA is aggressively trying to seize this market: in 2020-2021, the country plans to increase supplies to the Middle Kingdom by 12% — up to 6 million tons.

The Chinese market is attractive for exporters not only for large volumes, but also for high prices for wheat.

In the PRC, cereals are mainly used to feed livestock — meat consumption is constantly increasing.

And the Chinese millers have complaints about the quality of Russian grain — it is not always stable.

But our country continues to strengthen cooperation with the Republic of China, so hopefully it will gradually lead to an increase in supplies.

Today, cereals are in 6th place in the TOP — 10 among goods exported to China, but with a very small percentage.

According to the analytical platform Logistic OS, since the beginning of the season, 21,500 tons of cereals and legumes have been exported to China, mainly soybeans and corn, while 137,365 tons were shipped during this period last year — up 84%.

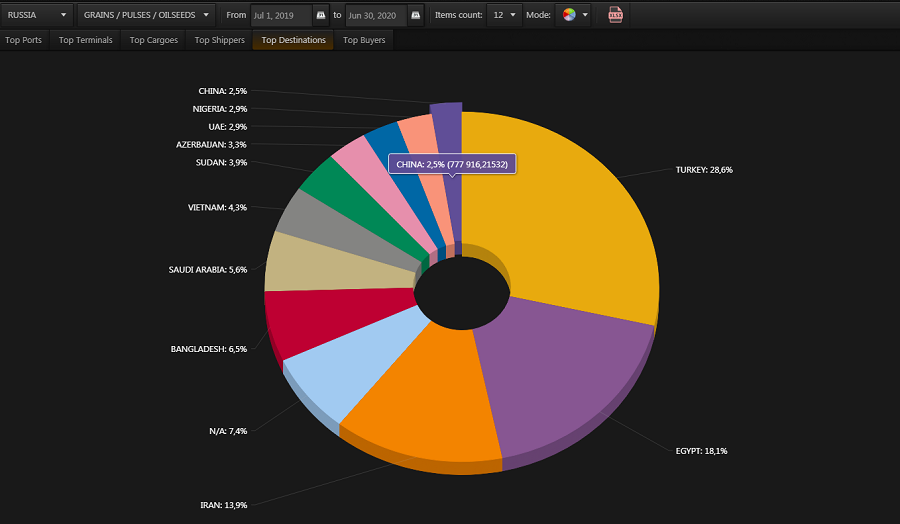

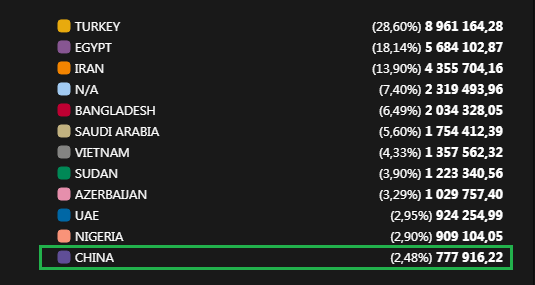

Although in the last agricultural year, China was in 12th place in the TOP — 12 countries to which Russia exported grain.

So far, Russia is unlikely to be able to take advantage of the increased demand for wheat in China, but there are still enough countries in the world that are interested in exporting Russian wheat, which allows it to stand firmly on its feet in the global export market.

(the analytics was carried out on the basis of the Logistic OS platform using Ratings and Export Data)