In the past two decades, the world soybean market has shown very high growth.

First of all, this is due to the growth of the livestock complex and, as a consequence, the growing demand for soybean meal as a fodder base.

In addition, there is a growing demand for soybean oil as one of the elements of a healthy diet and a component in the production of biofuels.

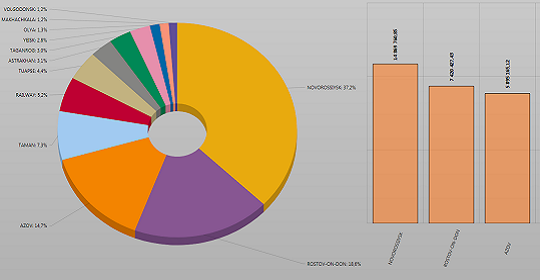

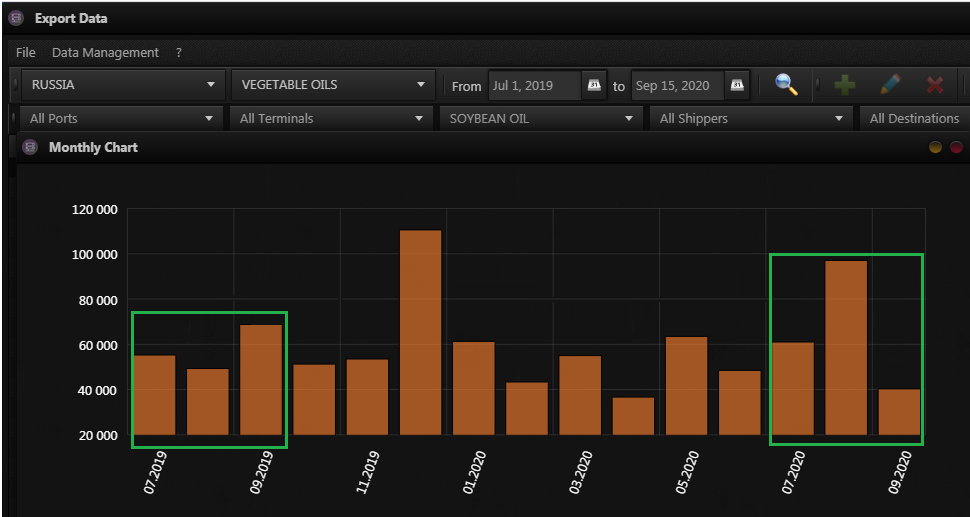

According to the analytical platform Logistic OS, since the beginning of the current agricultural year, Russia has exported 199 thousand tons of soybean oil, increasing sales by 48.5%.

Global soybean production in 2010 — 2020 increased by 29%, reaching 360 million tons in the 2018/19 season.

True, due to unfavorable conditions for sowing soybeans in the United States, in 2019/20 there was a decrease in crop harvest to 337 million tons.

But already in the 2020/21 season, a record harvest of 363 million tons is expected.

The undisputed leaders in the production of soybeans are the United States and Brazil. The latter, thanks to a decrease in the US harvest in 2019/20, came out on top last year in the world, and is likely to keep it in 2020/21.

These countries also top the list of the largest exporters of soybeans, with a combined 80% market share.

Also, the TOP-5 manufacturers included Argentina, China and India.

In turn, China is not only a producer, but also the largest processor of culture: more than half of all world purchases come from the Celestial Empire.

According to analysts, in 2020/21, the country will produce 75 million tons of soybean meal and 17 million tons of soybean oil.

Over the past 10 years, soybean production in Russia has outpaced world production: over these years, the harvest has grown 4.6 times to 4.4 million tons last year.

Geographically, soybean production is distributed in two regions: the Central Federal District — 49% and the Far Eastern Federal District with a share of 31%.

The regions are also divided in terms of their logistics: in the central part, soybeans are mainly processed for processing, and the Far East region occupies an export niche, focusing mainly on China.

Despite the reduction in planted areas in 2020 by 6.8% (to 2.8 million hectares), experts expect the harvest to be at the level of 2019 and even higher: about 4.8 million tons.

The main task facing Russian producers is to increase the production of soybean processing products both for the domestic market and for export.

The demand for non-GMO meal is growing in the world: supplies to the Netherlands, Poland, Denmark, Germany, and Finland are growing.

Also, China is planning to purchase Russian meal.

According to preliminary forecasts, the total export of soybean meal will amount to 644 thousand tons. That is 49% higher than last year.

The demand for soybean meal is growing both in the world and in Russia.

To minimize the cost of purchasing this important feed component, livestock enterprises, for example, Cherkizovo, are investing in the construction of their own soybean processing facilities.

In the second half of 2022, the company plans to commission an oil extraction plant in the Yeletsky district of the Lipetsk region, which will produce soybean oil, husk, meal, and lecithin.

Investments in the project, according to preliminary estimates, will amount to 11.3 billion rubles, of which 7.2 billion rubles will be directed to the already under construction MEZ, and the rest of the volume is expected to be invested in the construction of a feed mill with an elevator for 182 thousand tons and a soy protein plant.

The MEZ will become the largest in Russia and will contribute to solving problems of import substitution: they plan not only to sell products within the country, but also to develop the export direction.

But the company will give priority to direct contracts with Russian consumers: livestock and poultry complexes, food processing enterprises that use imported ingredients.

In general, the domestic agricultural sector is entering a higher stage of development, moving from narrow specialization to the creation of vertically integrated chains.

Large enterprises try to close the production cycle «from field to counter» at the expense of their own facilities, thereby increasing the profitability of the business.

(Analytics based on Export Data application)