We analyze the dynamics of grain exports based on the Logistic OS platform.

Wheat price breaks record after record, and exporters continue to actively ship grain.

From 11 to 20 October 2020, Russia exported 1 702 089 tons of grain.

This is 2.96% more than for the period from October 1 to 10, 2020 and 34.2% more than the same period last year.

Since the beginning of the agricultural year, a total of 18 343 thousand tons of grain have been shipped. The increase compared to last year was 4.1%.

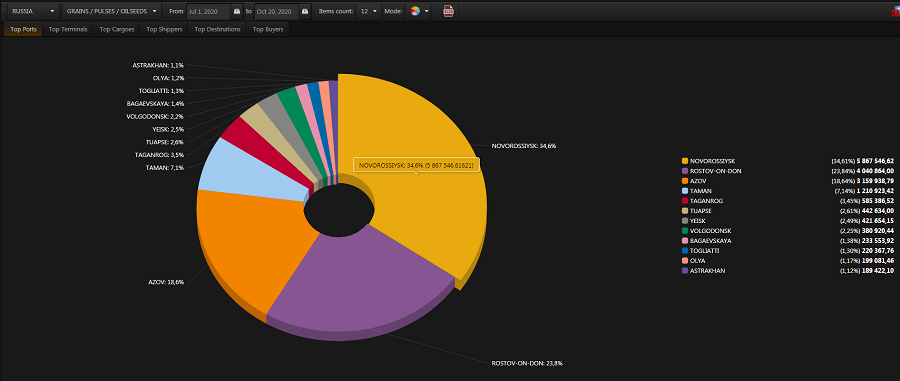

The main shipments went through the terminals of Novorossiysk — 34.61% of the total volume.

But while Novorossiysk increased its transshipment volumes by 14%, the terminals of Rostov-on-Don added 31.5%.

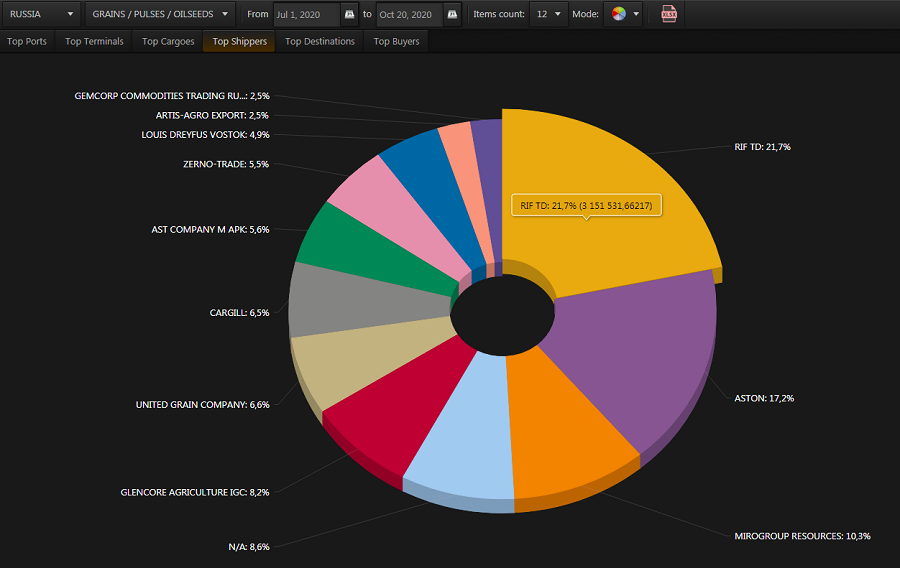

Leading exporter — Trading House «Rif» LLC.

From July 1 to October 20, they exported 3,151,531 tons of grain: + 41.5% to last year.

Aston holds the second line of the rating in terms of export volume, but with a much larger increase of 75.8%.

Mirogroup Resources LLC remains in the top three: + 5.5%.

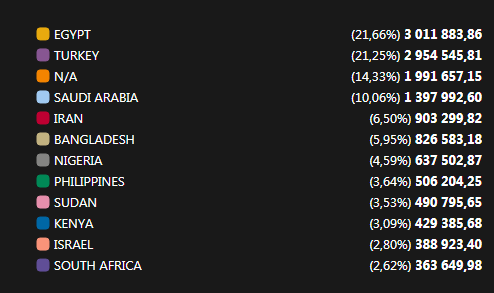

01.07 — 20.10.2019

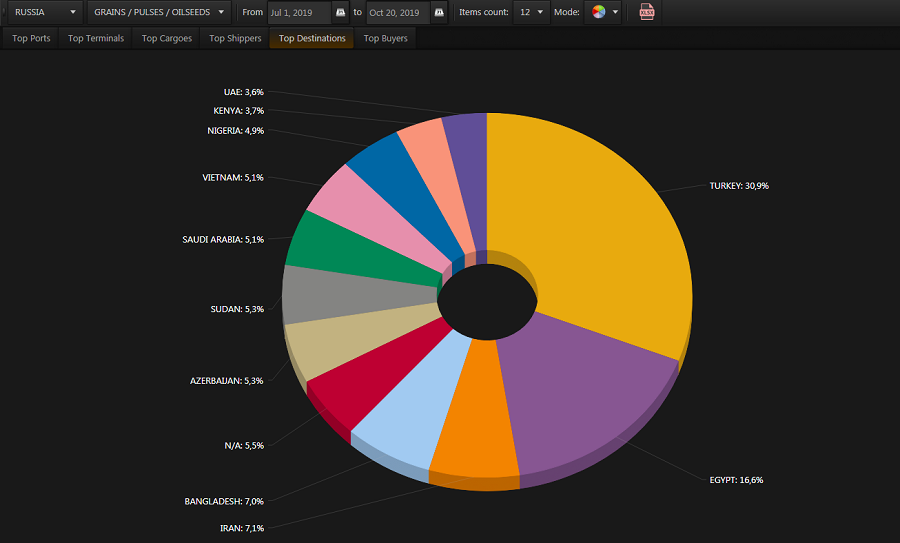

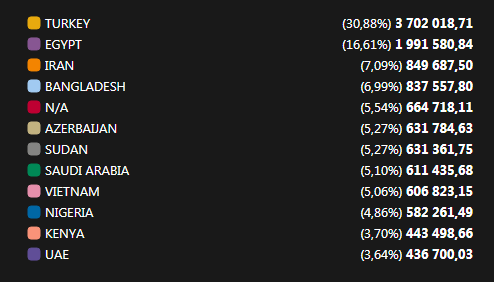

01.07 — 20.10.2020

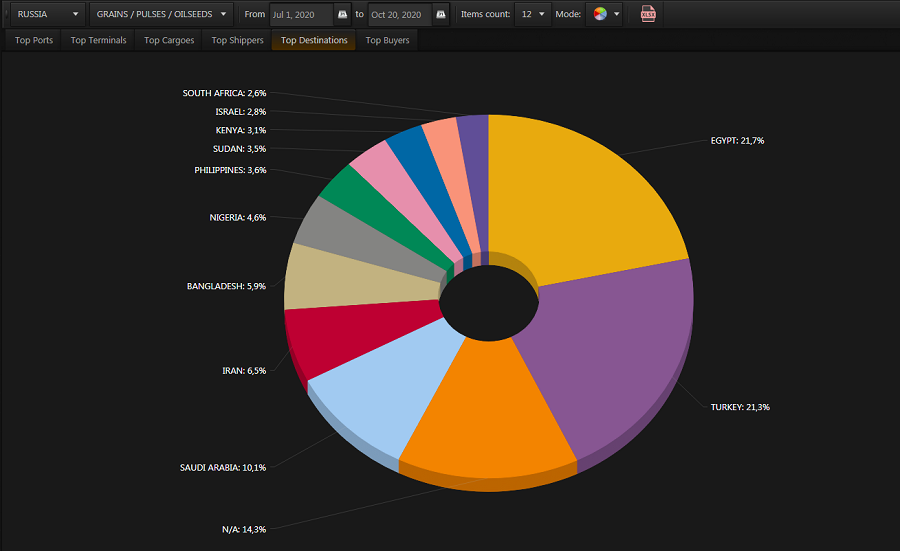

Egypt has established itself as the main importer of Russian grain, increasing imports from Russia by 51.2%.

Turkey moved up to second place, reducing purchases by 20.5%.

01.07 — 20.10.2020

01.07 — 20.10.2019

The main shipments this season were made to Egypt, Turkey, Saudi Arabia, Iran, Bangladesh and Nigeria.

For a long time, negotiations were underway on Russia’s admission to tenders for the purchase of wheat for Algeria, and, at last, just the other day, such an agreement was reached.

Traditionally, France dominates the Algerian import market, but, as noted by the Head of the Algerian Interprofessional Bureau for Grains, the country plans to update the short list of wheat exporters and include Russia there.

Algeria has changed the requirements for wheat imported from Russia, reducing the percentage of infestation by a turtle bug from 0.1% to 0.5%.

Russia, with its high yield, could well have supplied 1-2 million tons of wheat to the country, but even taking into account the decrease in phytosanitary requirements by the importing country, not all Russian producers will be able to provide the required quality.

It should be noted that for France, which «closes» 50-80% of the Algerian crop import market, the requirements are much softer.

Among other things, Algeria reduced the quota for soft wheat from 5 million to 4 million tons, plus 1 million tons of durum, and stopped subsidizing imports.

On October 22, Russia was admitted to the Algerian tender for 720 thousand tons of wheat, but exporters from France and the Baltic countries won.

With such requirements for grain quality that Algeria makes, it will be difficult for Russian producers to rely on this market, but Russia’s admission to tenders, albeit on such conditions, is undoubtedly a breakthrough.

Russia will continue to seek to ease the terms of delivery to this country.