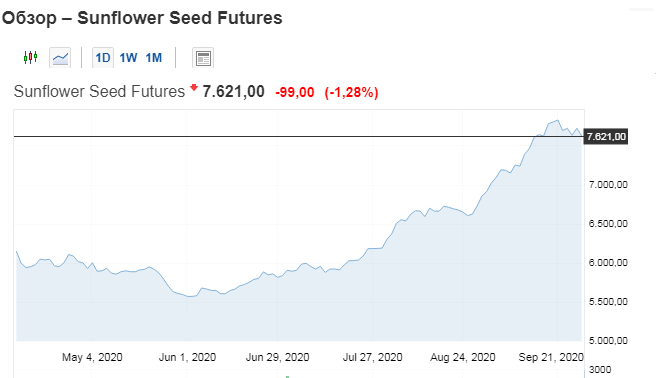

During the last week, after the highs reached, prices have fallen on the world market.

Since August, sunflower and sunflower oil prices have increased by 35% and 22%, respectively. In monetary terms — 34 and 71 thousand per ton).

The estimated harvest is almost a quarter less than last year. Lower figures were only in 2017.

Then it was collected 10.5 million tons, the optimistic forecasts for this year stand at a maximum of 12-13 million tons.

In principle, the rise in prices for culture this year was natural against the backdrop of a lean year not only in Russia, but in Ukraine.

As you know, Russia and Ukraine control almost 80% of the sunflower oil markets.

In addition, the weak ruble and increased demand from importers drove the price down.

Prices reached their maximum on world markets the week before last (09.21.20): against the backdrop of confirming data on a bad harvest of the largest exporting countries.

After that, the quotes chart went down.

Experts believe that the downward trend will continue, and several factors will support it: a decline in oil prices and fears of a new wave of COVID — 19.

Possible restrictions, against the backdrop of a new round of growth in the incidence of diseases in the world, are forcing buyers to be wary of purchasing vegetable oils, including due to the forced reduction in consumption for the product as such and for its derivatives (biofuel).

If strict quarantine measures are introduced, some of the buyers are likely to switch to monthly contracts.

Two weeks ago, the situation with the price for Russian producers was more optimistic: there was demand, but there were no significant replacements for Russian and Ukrainian supplies on the world market — Argentina, France, Serbia are not so significant.

But after September 21, world quotations began to decline against the backdrop of the beginning of sunflower processing in Ukraine (before that there was no raw material).

Vegetable oils markets will remain under pressure from declining demand and seasonal production growth this week.

In addition, Russian oil has become too expensive for foreign buyers.

At the same time, for 9 months of this year, Russia has increased the export of sunflower oil by 30% compared to last year .

This growth became possible due to the rapid growth of supplies to China (2.5 times) and India (4.5 times).

China remains the largest buyer of Russian fat and oil products since 2018. 60% of soybean oil exports from Russia also go to China.

Over the past year, the supply of rapeseed oil to China has increased.

According to the Deputy Minister of Agriculture of the Russian Federation Sergei Levin, by 2024 Russia can occupy up to half of the export market of the PRC and up to 30% of India.

The growth of income of the population of these countries is growing, and, accordingly, the consumption of a more expensive product is growing.