We analyze the dynamics of grain exports based on the Logistic OS platform.

Despite the fact that the price of wheat went down, the first week of November for exporters passed in a dynamic mode, practically not slowing down.

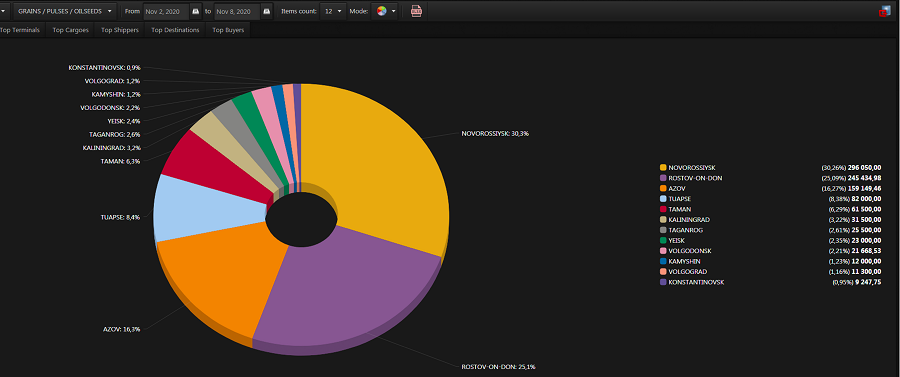

From 02 to 08 November 2020, 1,024.8 thousand tons of grain were shipped, which was almost equal to the result of last week — 1,042.4 thousand tons.

02.11 — 08.11.2020

26.10 – 01.11.2020

The terminals of Novorossiysk slowed down a bit: — 20%.

On the other hand, the transshipment volumes in Rostov-on-Don increased by 37.6%.

Analysts expect a significant increase in wheat exports in November-December 2020: 4.5 million tons against 2.7 million tons in November last year.

The explanation is simple: exporters expect the introduction of quotas from January 1, 2021.

Small companies are experiencing the hardest part of this period: the number of exporters is gradually decreasing towards large players, and the export restriction this spring has accelerated this process.

Last year, 62 companies operated on the grain export market, 45 of which worked in October, but after the restrictions were introduced in April 2020, the number of market participants dropped to 24, and then to 7.

Most likely, this year we will see a similar situation.

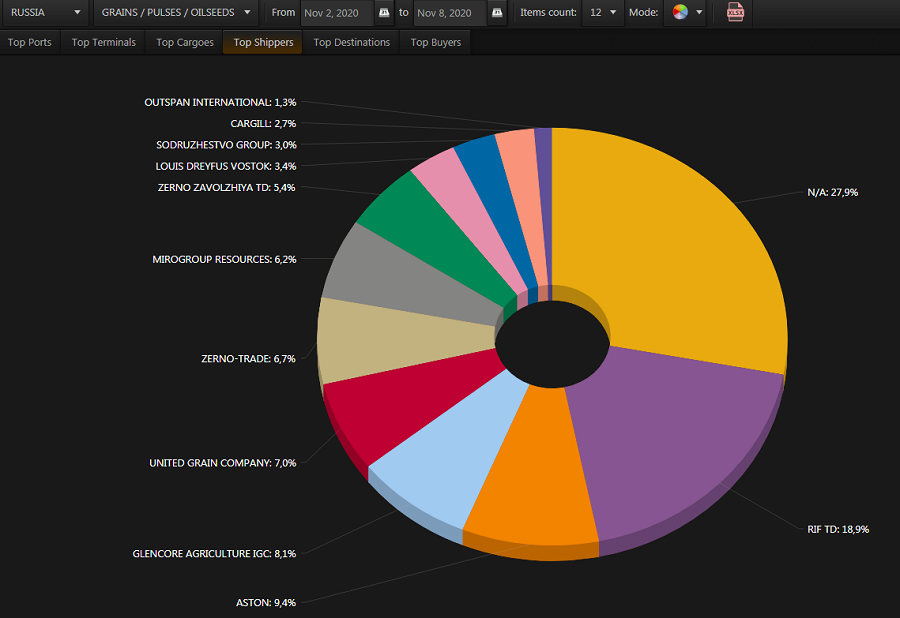

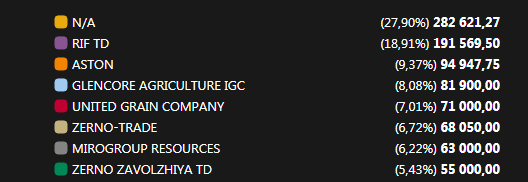

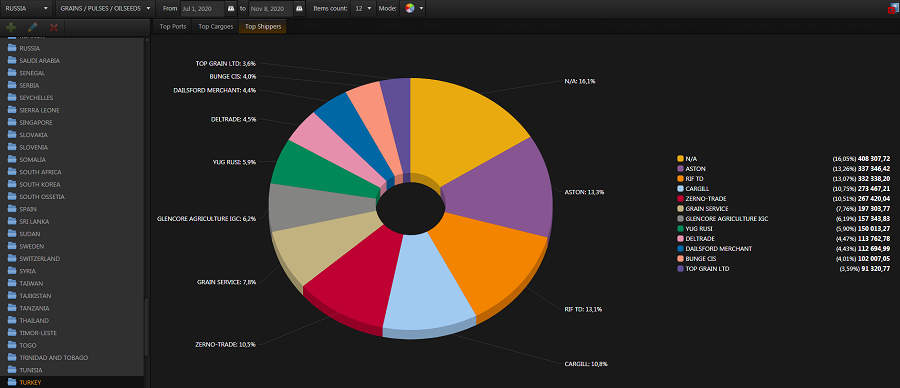

Large companies occupy the bulk of the grain export market:

Trading House “Rif” LLC added 41% to the last week’s shipments, closing almost 1/5 of the entire domestic grain export market.

Aston JSC, although it moved to the second place, but decreased its turnover by 29.8%.

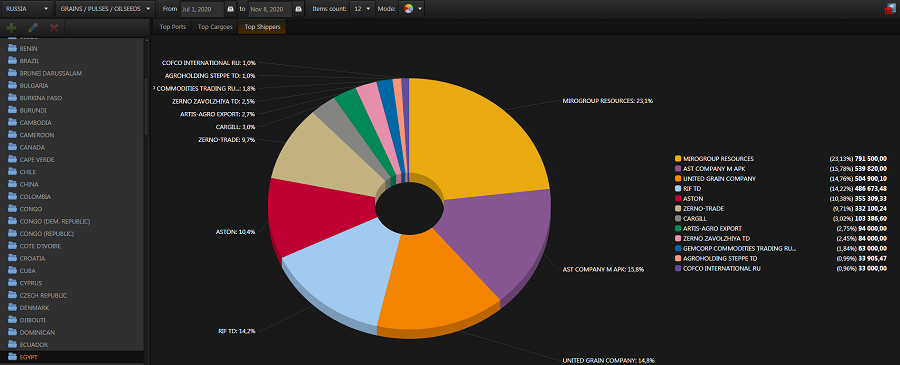

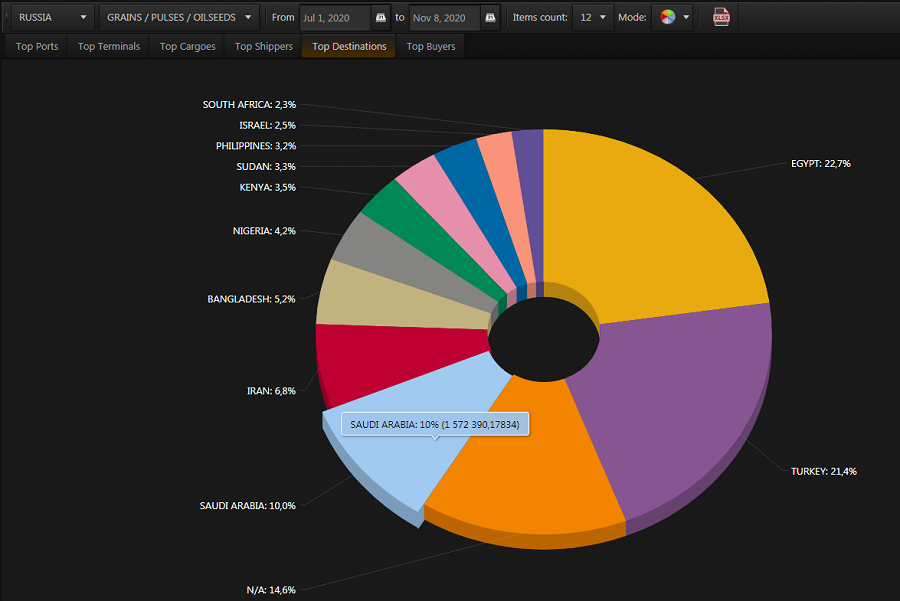

The main importing countries are still Egypt and Turkey, to which certain groups of companies carry out supplies.

For example, the main supplier of grain to Egypt is LLC Mirogroup Resources, which since the beginning of the season has carried out 23.13% of the total volume of shipments.

Next, with almost equal shares are LLC Agroindustrial Corporation AST Company M, JSC United Grain Company, LLC TD Rif and closes the top five JSC Aston.

If we consider Turkey, then Aston JSC and Rif Trading House LLC are leading here with 13.1% and 13.3% of turnover, respectively.

Cargill and LLC Zerno-Trade are in third and fourth positions with 10.8% and 10.5%.

Since April of this year, Russia has restored shipments to Saudi Arabia after the opening of this market in the summer of 2019, and by now the country has entered the «five» major importing countries of Russian grain.

In the future, Russia’s presence in the Saudi market can be expanded and take up to half of wheat imports to this country.

(Analytics based on Ratings and Destinations applications)