Analysis of export shipments of grain based on the Logistic OS platform.

Export shipments of grains and legumes continued to fall last week.

Against the background of rumors about the possible introduction of quotas and the establishment of export duties on the export of wheat (and now facts), the price of wheat on the US stock exchange has increased, but importers are more focused on buying it not from Russian suppliers.

European importers assume that against the background of the introduction of restrictions, supplies from Russia will slow down, which caused additional demand for supplies from the EU.

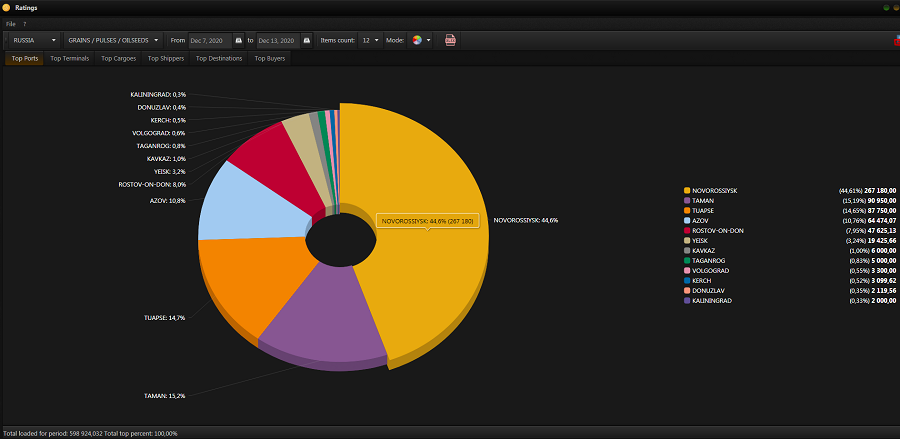

From December 07-13, 2020, Russia exported 598.9 thousand tons of cereals and legumes, of which 530.8 thousand tons of wheat.

This is 33% less than the previous week and 18% less than the same week last year.

As a result, since the beginning of the month, 1,126 thousand tons of wheat have been exported abroad.

Let us remind you that initially the export potential of December was estimated by experts at 4.5-4.7 million tons.

Currently, the estimated sales are more than 50% behind.

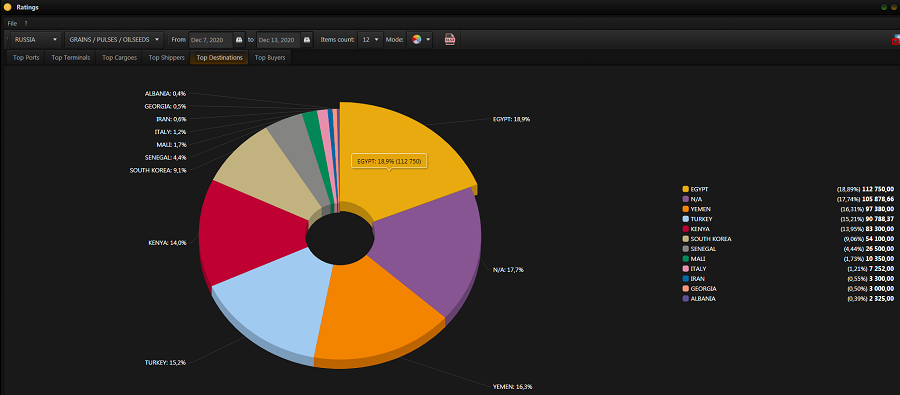

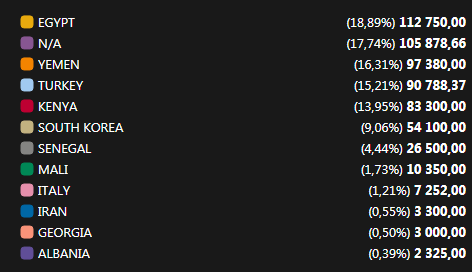

Egypt remains the main importer of Russian grain, where almost 19% of shipments went.

Although, in comparison with last week, the country purchased 64% less grain from Russia.

Not far from Egypt in terms of shipments, the rest of the importing countries also left: Yemen, Turkey and Kenya.

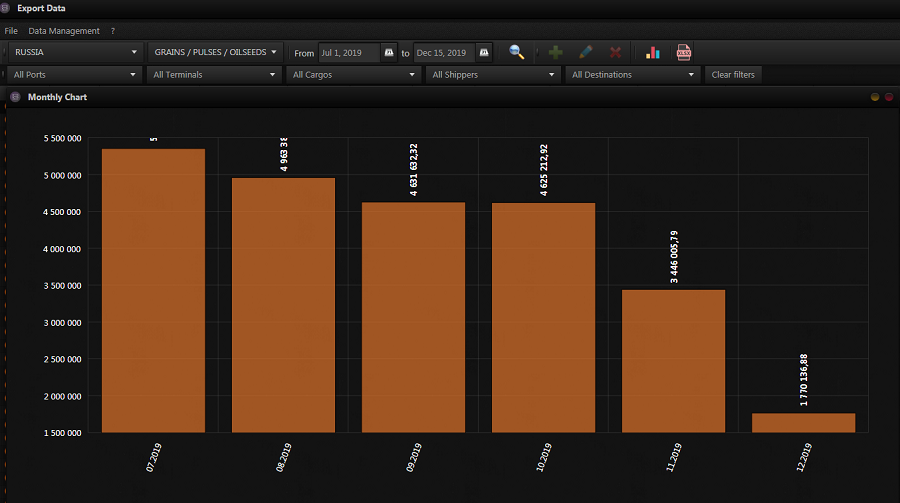

If we compare the dynamics of this and the previous season, then it looks completely different.

2019

2020

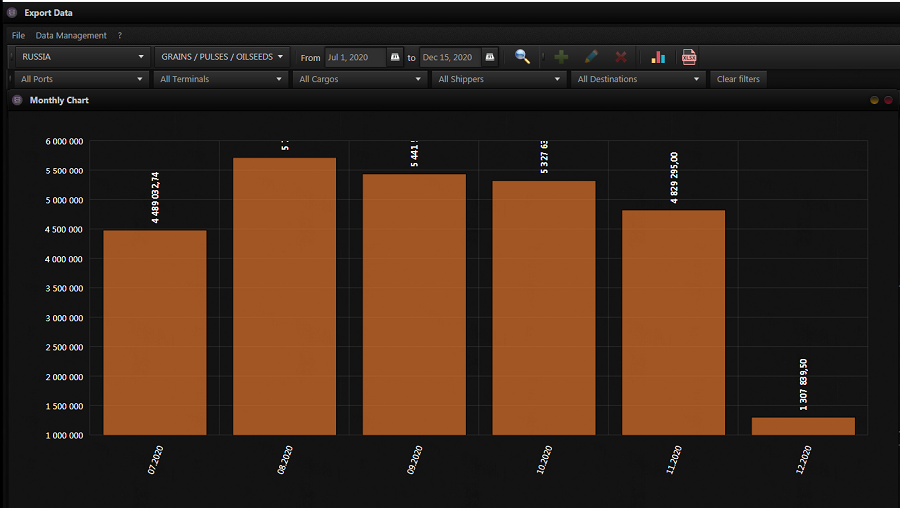

Russia increased its export volumes from August to November 2020, practically without slowing down.

The first half of December both this and last year showed a significant decrease, but, compared to last year, the gap between November and the first half of December is clearly not in favor of this year’s results.

The introduction by the government of emergency measures to regulate food prices, according to experts, will negatively affect the export market.

This can reduce both the inflow of investment into the industry and the achievement of targets.

And most importantly, undermine Russia’s position in the world market.

The analysis was carried out on the basis of the Export Data and Ratings applications