Interview APK-Inform IA with General Director of the TBI Group Ivan Karamanov.

— Ivan Dmitrievich, at the beginning of our conversation, by tradition, let’s sum up the results of the outgoing year. It was eventful for all of us, but what will be the most memorable for TBI?

— TBI company is no different from the rest of the business. Therefore, like everyone else, it was very difficult for us in the context of the pandemic and the associated consequences. Probably the most significant event this year was that we entered a new project, we became operators of one of the largest container terminals in the port of Novorossiysk — NKK — Novorossiysk container complex .

We took up the project from the very beginning of 2020, and then no one knew what would happen a little later: quarantine would be introduced, cargo flows would drop, and our terminal would practically remain without cargo. We had to “reinvent the wheel” on the fly and figure out how to load such a large terminal and, most importantly, keep a team of about 100 people. This, perhaps, was the most «fun» time and test for our company. But we survived, saved the team, brought the terminal out of the crisis, and now everything is fine, the terminal is operating in standard mode . Therefore, everyone is welcome with the cargo that you plan to send for export in containers, or to receive imported container cargo.

There was practically no impact of the pandemic on railway logistics. We specialize in the transportation of grain cargo, and grain moves by rail regardless of the pandemic.

— A year earlier, you announced your plans to expand the coverage of the company in Russia and the Siberian Federal District. Tell me, did you manage to win the hearts of Siberian companies?

— Since this region is complex and has its own peculiarities, we decided to find a partner who knows well the peculiarities of working in Siberia. We are now at the stage of the negotiation process and discussion of our future cooperation and its terms.

— Tell us how things are with the Kazakhstani direction? What results have you achieved?

— Unfortunately, our project of transshipment of Kazakh grain through the port of Novorossiysk by the direct «car-to-ship» method has collapsed. But neither Kazakhstani exporters, nor we are to blame for this. So there were circumstances that the Novorossiysk port, in principle, refused to work with grain cargo. I will not comment on this situation further. The only thing I want to say is a big thank you to our partners in Kazakhstan — Fergus and Agromin companies, who believed us, went with us to this very complex logistics project and lived it with us for two years. I really hope that it was a good experience for everyone, albeit a short one. Everything is changing in our world, so we do not give up the hope that the situation with the Novorossiysk port will change and we will resume this project, especially since we have already gone through and tested the hardest things in building this work, got good results and valuable experience.

— You have experience in both Russian and Kazakhstani markets. How different are the specifics of their functioning? Are there any noticeable differences in the mentality and approach to the work of partners from different countries?

— you know, of course, in every country, moreover, I would say, even in every region (if we take the Russian Federation) there are peculiarities in doing business , and in the mentality of people, the question is how much you have studied your partners and understand them correctly. But if people want to do business and try to hear each other, then everything works out, despite the specifics and differences in mentality, and our cooperation with Kazakhstani companies is a vivid example of this.

— One of the areas of your activity is rail transportation and forwarding. What difficulties do you have to face both in Russia and in Kazakhstan?

— We have very similar difficulties with railway logistics — both in Russia and in Kazakhstan.

I’ll tell you this: all railroads always have two difficulties:

— a big harvest: there are not enough railway wagons to transport grain, there is a shortage, and the market is in a fever;

— small harvest: there is nowhere to put the railroad cars, which turned out to be superfluous and not used in grain transportation. Downtime of wagons without loading carries high costs for their owners

These are perhaps two major global problems for everyone. Everything else is just particular.

— The memorandum adopted on September 15, 2020, aimed at combating overloading of vehicles during the transportation of grain and oilseeds, led to increasing the attractiveness of railway transport and increasing demand for it. How tangible are these changes for you?

— Indeed, the fight against overloading on road transport has begun to attract more players of the grain market to railway transportation, and at the moment the demand for grain wagons exceeds the capabilities of railway operators, and there is a steady shortage of them. But here several factors have come together: the fight against overloading, and the fact that a large amount of grain has been produced in the central part of the Russian Federation and the Volga region, and it is from these regions that grain travels by rail towards ports, and in the south of the country, where traditionally trucking prevails, on the contrary, the harvest was not reaped. These are, respectively, two main factors that played into the hands of railway operators. But this is not always the case.

— The Russian market of containerized cargo transportation in 2020 continued to develop gradually. What is the reason for the growing interest of consumers in this mode of transportation?

— All over the world, the container transportation market is growing at a very high rate. A number of factors contribute to this. Firstly, anyone can send any amount of cargo by container — at least 10 tons, at least 10 thousand tons, which in itself gives a market participant (regardless of its size and financial condition) to try his hand at business, and in particular in international trade.

Secondly, what is most important, in order to send your cargo in containers, you do not need access to ports, since getting it is a rather complicated procedure and sometimes not everyone can do it. In container shipments, the exporter or importer only needs to find a good container logistician who will accept the cargo, repartition it from a railway or car into a container, draw up all the necessary documents, send it to the port of destination, and you just have to get all the documents from him on your shipment and forward them to the buyer.

Accordingly, container shipments were and remain very attractive for a large number of both experienced and novice players.

Again, not all buyers can accept medium or large steamers, and in small container batches they can accept a fairly large volume, well, the risks are evenly distributed in such shipments. < / span>

— Perhaps there are factors hindering a more dynamic growth in container traffic?

— This is just a similar situation, as it is now with the pandemic. Let me explain: export container shipments are directly dependent on imports arriving in containers in a particular country. Since, if imports are reduced, a shortage of containers is formed, many participants do not have enough containers to send their cargo. And what happens when there is a deficit? That’s right, raising prices. And then there is a double blow to business: on the one hand, there are not enough containers to dispatch the cargo under the contract on time, on the other hand, the cost of freight rises (i.e., delivery of the container to the port of destination). And as soon as the pandemic began, production decreased, imports fell, there was immediately a shortage of container equipment for export, and, as I said, container lines immediately raised freight rates. Such situations significantly hinder the growth of container traffic. But let’s hope that the crisis is over. We see that everything is slowly recovering.

— How did the directions of container deliveries change and the shares of main cargo were redistributed at the end of 2020? What is causing this?

— There are no significant changes, everything is more or less standard, the main container traffic as it was to the countries of Southeast Asia, so far remains.

In my opinion, this flow will not change, since the population in this region at the moment and at least in the near future will only grow and, as a result, the demand for products, in particular grain, will also increase, which will continue to stimulate the growth of container shipments in this direction.

— Another brainchild of your company is the LOGISTIC OS project — a necessary tool for many companies. Based on the available statistical data, please tell us what key changes were noted in the distribution of supply volumes and items during the first half of 2020/21 MY? Has there been an increase in niche grain exports?

— Indeed, the Logistic OS analytical platform is becoming more and more in demand among participants in the export market, because it allows not only analyzing the current situation in ports, but also seeing the overall picture of the external market. This, in turn, allows you to navigate a rapidly changing economic environment.

Back in 1815, Nathan Rothschild said a phrase that should become the motto of every businessman: «Who owns information, owns the world.» So we just accumulate the maximum information in order for the business of our partners to develop.

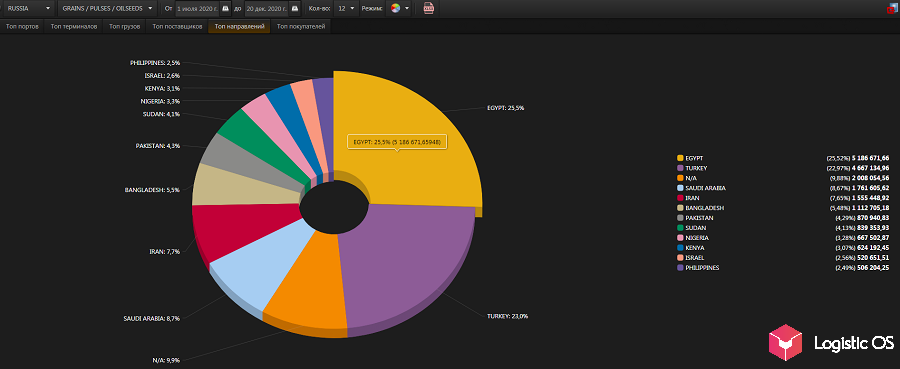

If we talk about the trends of the 2020/21 season, then the undoubted favorite was wheat, which made Russia a world leader in exporters. It accounts for more than 80% of Russian exports of grains and legumes. This season the leader among importers changed: Egypt became it, having shipped more than 5 million tons of grain from Russia and displaced the leader of the last season — Turkey.

But, besides wheat, there are niche crops that are not often written about in the press, but they also have a significant share in Russian exports and they have every chance to do their positions are more stable in the world market, especially in the light of current trends.

These are crops such as sunflowers, peas, soybeans, safflower, rapeseed, chickpeas and flax. In the import of these crops, it is Turkey that is consistently among the top three (let me remind you that we are talking about ship shipments). The export of sunflower this season has increased almost 3 times, and the rapeseed market has grown very strongly, with almost all of its share taken by Iran, increasing the volume of purchases by more than 2000%.

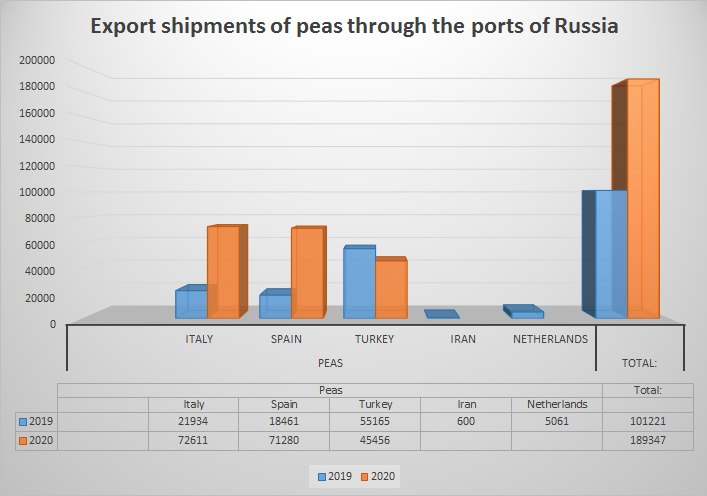

The same can be said about the export shipments of peas, which almost doubled.

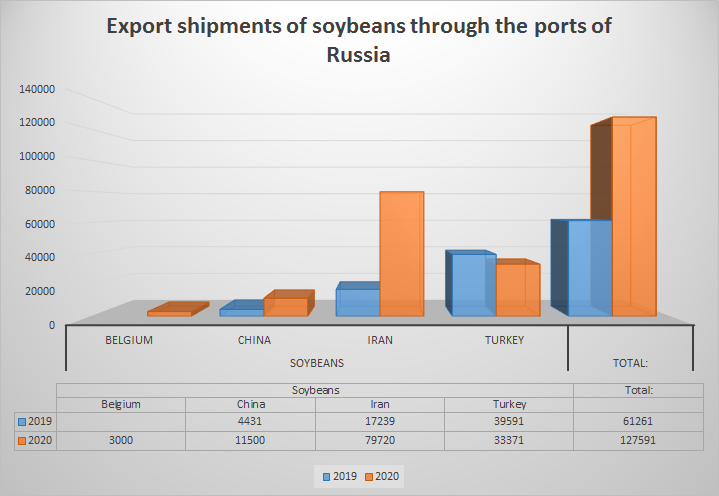

It is impossible not to note the growth of soybean shipments — more than 2 times.

Russia has a huge potential in this market — the market of China, one of the main world importers of this culture, is still poorly developed . And the territory of Russia makes it possible to significantly increase the area under crops, especially since China regards Russia as one of the main suppliers of soybeans, albeit in the distant future.

Chinese businessmen have already started to actively invest in the development of this business, and our exporters and manufacturers have time to pay more attention to this direction. < / p>

— What are your plans for the further development of this project?

— To date, the Logistic OS project has implemented the possibility of daily monitoring of Russian exports of grain, legumes, oilseeds, their processed products and vegetable oils. In addition, for the same products, since the spring of this year, we have started working with the Ukrainian market, and at the moment this information is provided for review free of charge. For an overview of the overall picture of the export of agricultural crops from the Black Sea region, we plan to add the markets of Romania and Bulgaria in 2021. Also in the short term, we plan to include other major global players in the export of agricultural crops . Today we already have partners from Argentina and Australia who are ready to work in our system, in addition, we are negotiating with colleagues from Brazil and are working on the issue of the USA, Canada, France and Germany. Looking into the future, the very goal of the Logistic OS project provides for the creation of an international system for trade between countries, therefore, in addition to the geographic expansion of data, we are considering the possibility of increasing the range of goods — coal, fertilizers, metals, etc., while we already have there are developments in the coal market in Russia. It is also worth noting that the formation of the main export flows will allow us to automatically generate the main import flows and users of the purchasing countries will be given the opportunity to get in one place a complete picture of the approach of vessels with cargo to unloading and their processing at the berths.

— If we talk about the plans of TBI GC as a whole, what goals do you set for yourself? < / span>

— In today’s conditions and taking into account the consequences of the coronavirus pandemic, our main task is to preserve the business that we have developed in the last 10 years, and we will talk about the company’s further development plans where something in a year. I really hope that by then the acute phase of the pandemic will pass and we will all return to our usual life.

Interviewed Alina Timofeeva