A grain quota of 17.5 million tonnes has been distributed among 234 companies.

The largest traders in the south of Russia, RIF Trading House and Aston, received a total of 27.5% of the total market volume (2.69 million tonnes and 2.123 million tonnes, respectively).

Besides them, the top five included Mirogroup Resources (1.759 million tons), Glencore Agro MZK (1.234 million tons), Cargill (892.53 thousand tons).

In general, companies included in the TOP-10 will be able to supply almost 70% of the quota to foreign markets.

But whether the entire volume of quotas will be fully selected remains a question, because the upcoming duty of 50 euros did not add optimism to agricultural producers. And the world importers have already practically purchased the required volumes.

The situation will become clearer after the forecast of a new harvest appears.

In the meantime, records are breaking one after another on the Russian market of major grain crops.

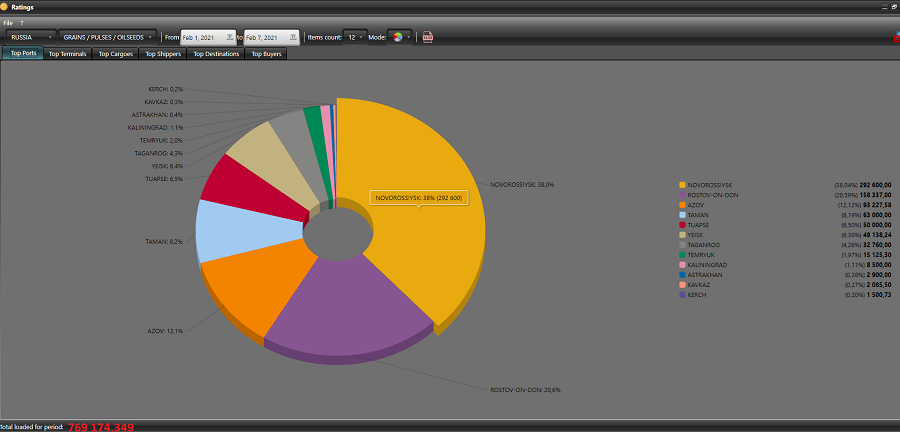

One week before the start of the restrictions, according to the operational monitoring system of the export market LogisticOS, 769,174 tons of grain were exported through Russian ports.

Last year, during this period, 486 798 tons of grain were shipped. This represents a increase of 58%.

In total, in the first half of the 2020/21 agricultural year, Russia exported 34.3 million tonnes of grain, including 29 million tonnes of wheat.

This is an absolute record. The previous one was installed in 2018/2019, when 32.15 million tons of grain were shipped.

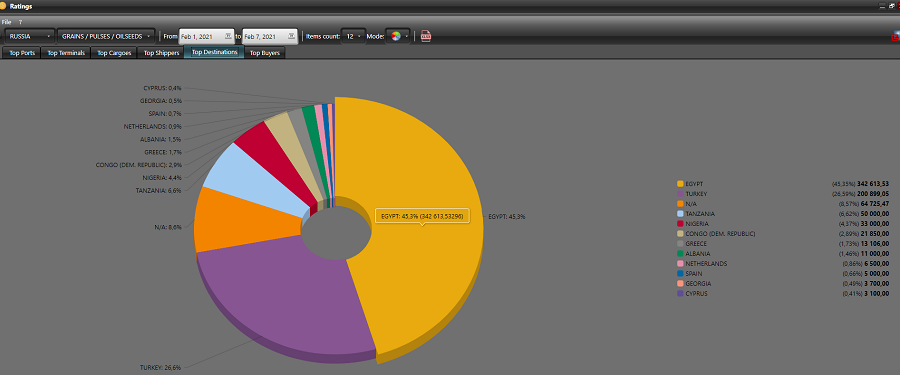

The bulk of grain in the first week of February was shipped to Egypt — 342.6 thousand tons.

Turkey is in second place — 200.8 thousand tons.

At the same time, Turkey added almost 189% in volume, while Egypt “grew” by 89.6%.

Despite the growing numbers, the Grain Union believes that the actions taken by Russia in the global grain market are alarming consumers, which, in turn, leads to higher prices.

According to the Grain Union, the increase in the price of wheat from $ 220 per tonne (FOB) in July 2020 to $ 285 today is only a 30-40% contribution from global trends. And the rest is just Russia’s export restrictions.

But even at this price, if you subtract all the costs and the amount of the duty, sowing wheat is unprofitable.

During the year, only fertilizers have risen in price by an average of 16%. In addition, they plan to raise the utilization fee for equipment, and significantly: according to rough estimates, two to three times.

Accordingly, the equipment itself will also rise in price.

Analytics based on Ratings