These companies sent abroad about 67% of the total grain volume through the seaports of Russia.

The ended agricultural season 2020/2021 clearly showed that the bulk of grain exports pass through several of the largest market participants.

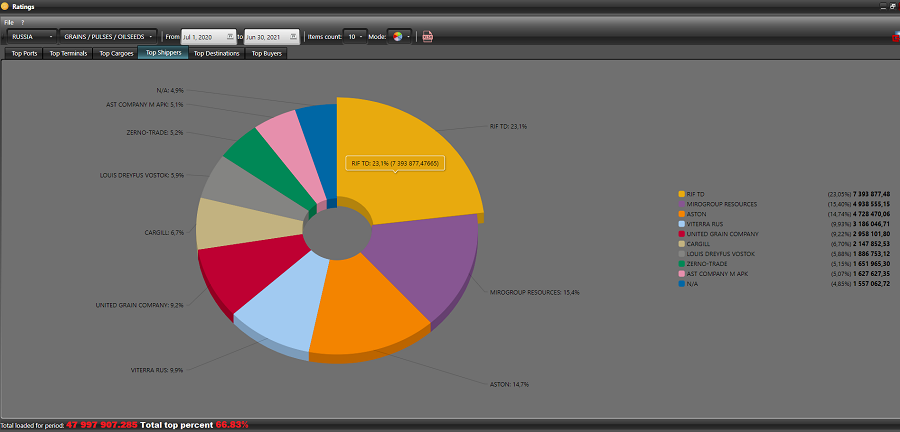

In total, according to preliminary data of the analytical platform Logistic OS , through the seaports of Russia exported 47 997 thousand tons of grain, 66.83% (32 077 thousand tons) accounted for 10 major exporters.

Compared to the 2019/20 season, the share of the largest companies in the total volume increased by 21.5% (+7 million tonnes of grain).

(According to the analytical platform Logistic OS )

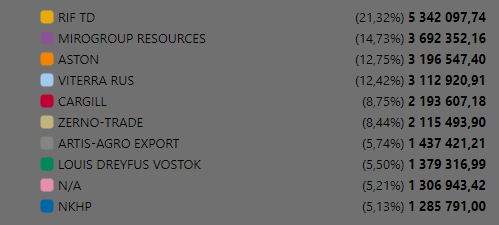

In the 2019/2020 agricultural year, the TOP-10 largest Russian exporters included:

In the 2020/2021 season, there were slight changes, but the TOP-4 remained unchanged.

Almost all major companies experienced growth in export volumes in the past year:

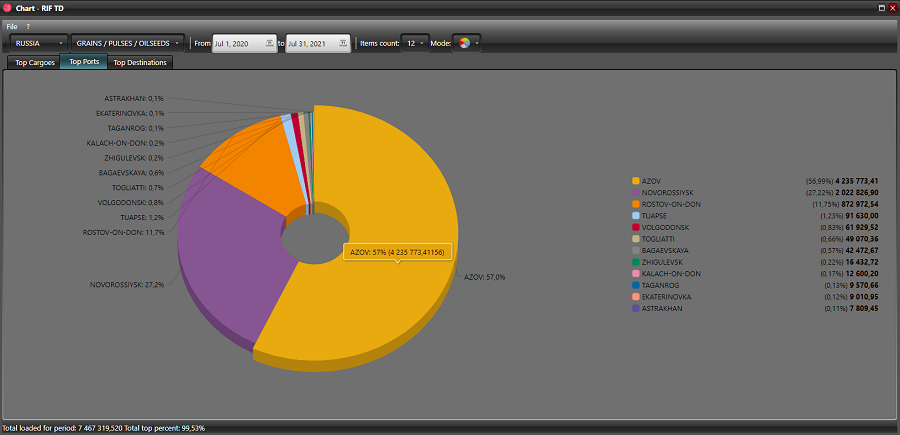

TD Reef: + 38%

The company shipped the bulk of the cargo through the sea terminals of Azov

(According to the analytical platform Logistic OS )

Mirogroup resources: + 33%

Aston: + 48%

Viterra: + 2%

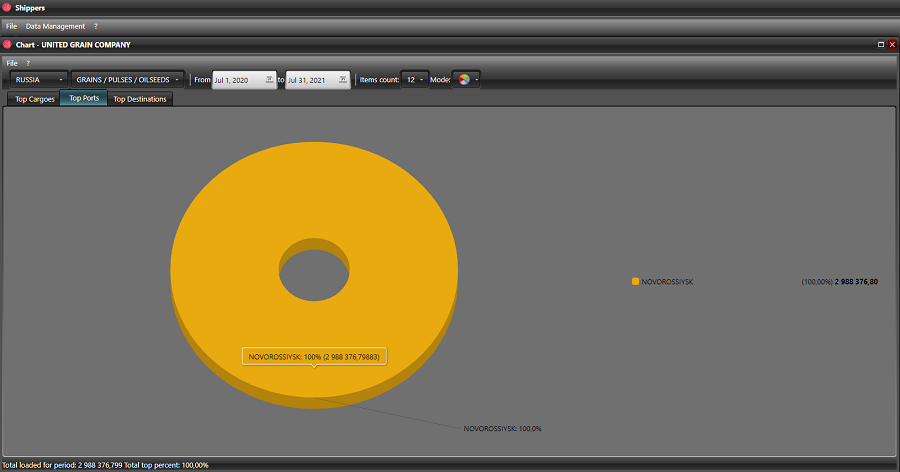

The United Grain Company became the leader in increasing export volumes through the seaports of Russia: + 138%.

(The company exports by sea through the terminals of Novorossiysk)

(According to the analytical platform Logistic OS )

Experts believe that the concentration of the bulk of grain exports among several of the largest companies is due to the fact that it is easier for them to adapt to new market conditions: these are quotas based on the historical principle, and a floating export duty that changes every week.

In the coming season, the TOP five is unlikely to change, but analysts expect the emergence of new exporters among large agricultural producers — their own grain should still allow better risk management.

It is possible that some large exporters will be able to significantly strengthen their positions through the construction of new and reconstruction of existing terminals.

If we talk about how the further consolidation of exports within several of the largest exporters will affect the overall state of the Russian grain market, then, so far, we can only state one point: the concentration of most of the exports among several large companies is a decrease in competition.

Reduced competition for grain means less benefit for farmers.

Analytics based on the modules Ratings , Export data and Shippers