Reason: skyrocketing prices and high shipping costs.

Traditionally, exports to Asian countries account for a third of the global grain export market.

In addition, the countries of Asia and earlier than others react to the change in the higher side of the price of wheat.

This position is due to relatively low per capita incomes and high cost of supplies.

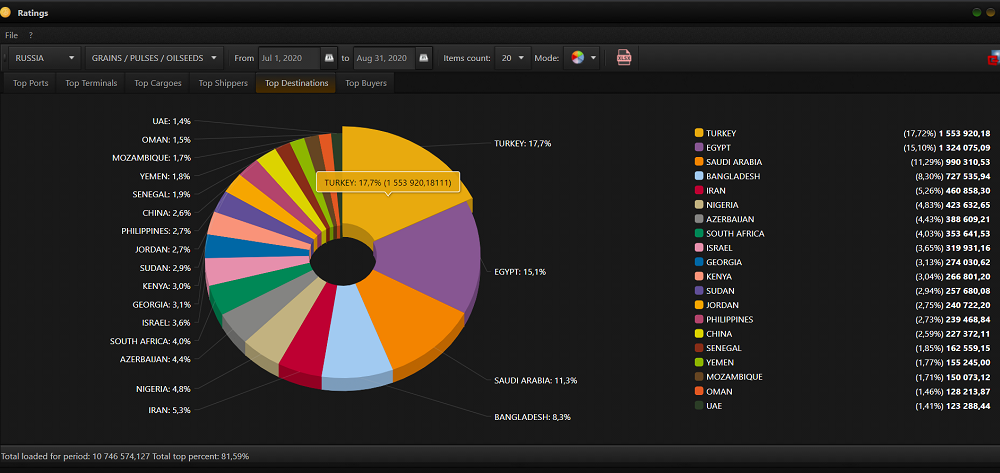

01.07 — 31.08.2020

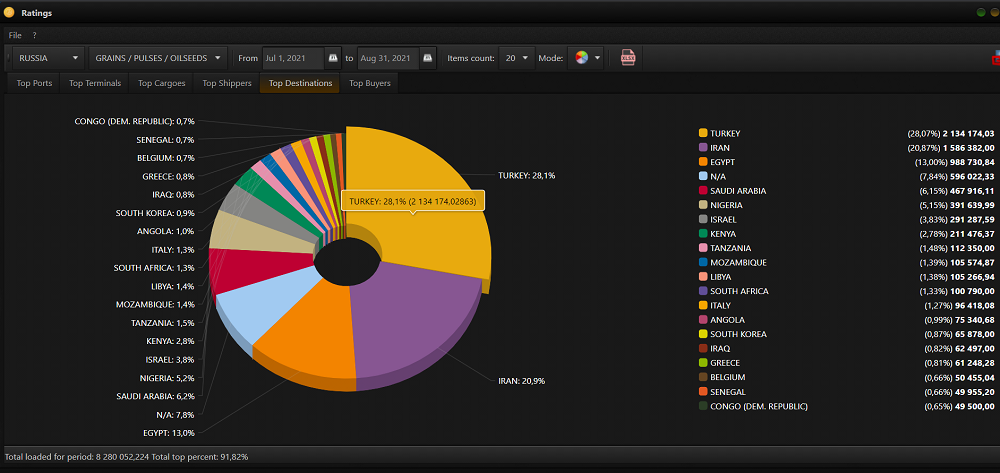

01.07 — 31.08.2021

Data on current shipments in Russian ports, historical data on grain shipments since 2012 can be generated on the basis of the analytical platform Logistic OS.

The system consists of several modules: Line-up, Export Date, Ratings, Ports, Cargoes, Vessels, as well as a large number of reference books.

Users are given the opportunity to use various analytical tools and download data in the format Excel.

When there is a need to obtain comparative data in the form of ratings, then in the «Ratings» module it is necessary to select the country, the type of cargo and the required period of time (in this case, the dates are selected: 01.07 — 31.08.2020 and 01.07-31.08.2021)

The resulting chart shows to which countries and in what volume the grain was shipped for export.

The platform accumulates data on export shipments since 2012, which allows you to compare indicators with the same period last year.

On the top menu bar, you just need to change the date.

To get free trial access for 1 month, follow the link

Delivery of wheat, for example, from Canada to Asian countries costs $ 35 per ton more than the delivery of grain from Europe and the Black Sea region for importers from North Africa.

One of the key players in the grain market, Egypt, is also greatly influenced by price increases.

For the first time in the last 10 years, the price of bread has been raised in the country, because subsidies have increased.

In addition, experts note a decrease in grain stocks in Asian countries: today they are already below the norm.

For example, the existing reserves in Indonesia will be enough to meet domestic needs only for 2-3 months, while usually this bar was at the level of 4 months.

The pandemic and high wheat prices have slowed restocking.

In this regard, it is noted that the volume of wheat processing this year in Indonesia may be reduced by 10%.

According to market operators, Australian farmers are holding back wheat sales in the expectation that prices will continue to rise.

At the beginning of September, Australian agricultural producers sold only 10-15% of the new crop, while 30% were sold by the same date last year.

The rise in wheat prices on world markets was caused by a decrease in production forecasts by world experts in Russia, Canada, and the EU countries — this led to a decrease in supply on the world market.

At the same time, China is increasing grain imports, which will undoubtedly increase competition in the global grain market.

In general, analysts USDA reduced the forecast of world wheat production in 2021/22 MY by 15.5 million tons, and experts IGC — by 6.4 million tons.