Will we give up the palm in the export of cereals and legumes?

For many years now, the export of grain and wheat flour has been a priority area of export policy.

This summer, our country has significantly stepped up shipments abroad.

Turkey and Egypt are among the major buyers. Iran has purchased more than 1.5 million tons of wheat — more than in the entire last year.

Demand from African countries is increasing.

At the same time, Russia mainly exports wheat with a protein content of 11-13%.

Ukraine occupies its own niche in the export of wheat: the protein content in it is 10-11%.

For most countries, where the countries of the post-Soviet space traditionally export grain, the gluten content is not such an important point.

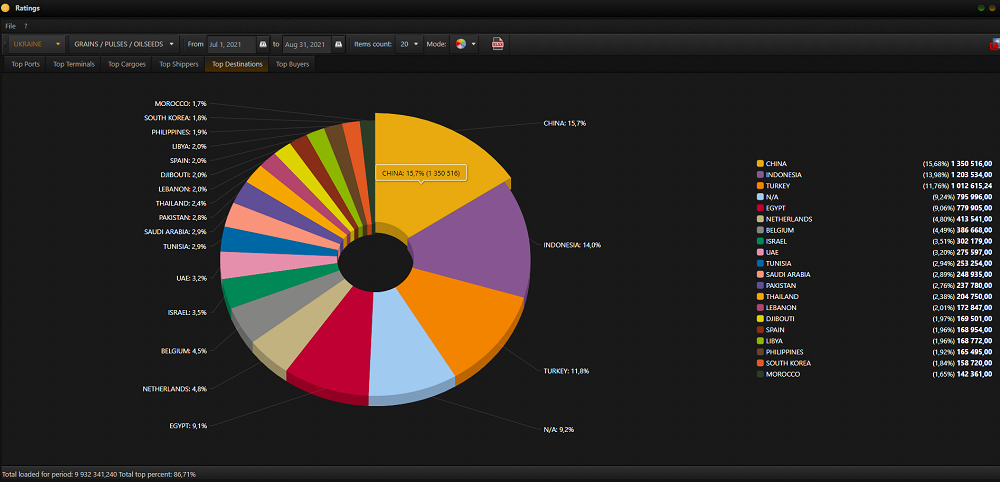

Ukraine supplies wheat to Jordan and the Philippines, but the main competition is for the markets of Egypt and Bangladesh.

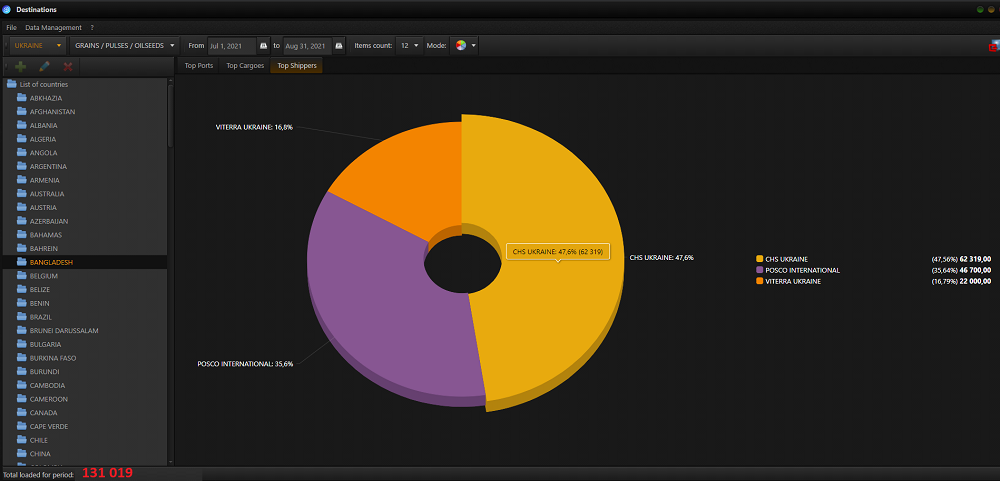

01.07 — 31.08.2021 Ukraine . Shipments to Bangladesh

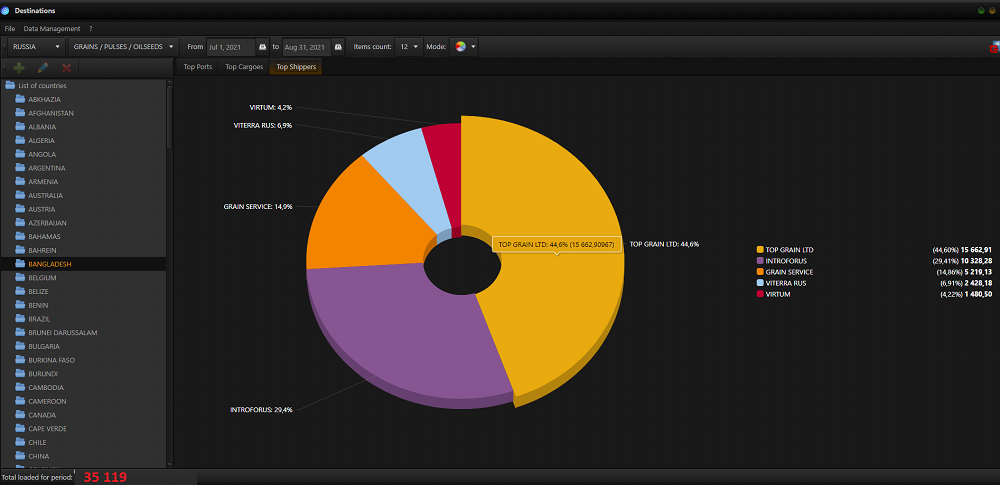

01.07 — 31.08.2021 Russia . Shipments to Bangladesh

What does such a small country have to do with it?

And the population of Bangladesh is 168 million people, which is more than Russia.

In addition, there is a billion-dollar India and a billion-dollar China nearby, where Ukraine is also actively shipping.

But the intrigue of recent days is the Egyptian tender for the purchase of wheat, where Ukrainian wheat was purchased 4 times more than Russian.

In general, Ukrainian and Romanian wheat is now bought better than Russian, in the first place, due to the lower price.

And the grain export duties introduced in Russia played an important role in this.

Of course, Ukraine, which has harvested a record grain harvest — about 32 million tons, which is 7 million tons more than in the past, this situation only plays into the hands.

Both Russia and Ukraine are members of the World Trade Organization and have no right to compete with non-market methods.

But in practice, these rules are often violated.

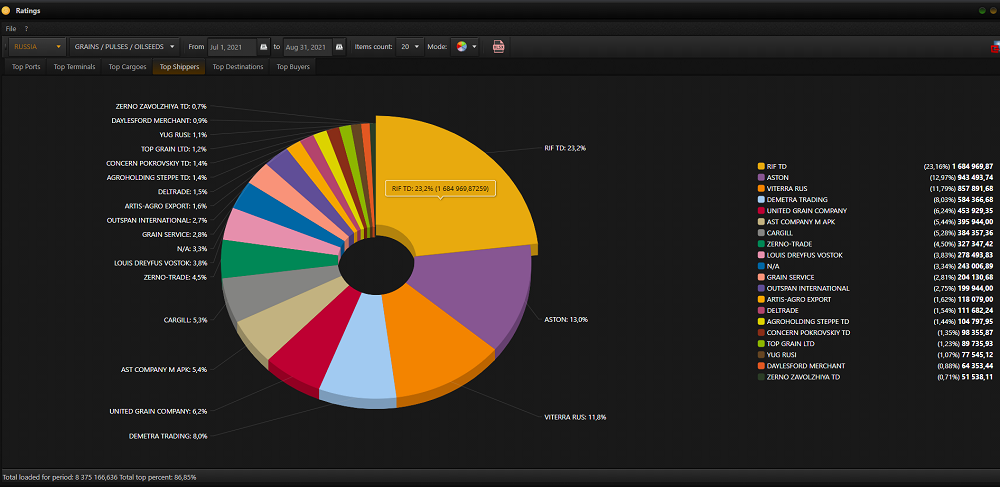

Meanwhile, with the introduction of duties, small companies leave our market that cannot compete with the oligarchs who have their own port infrastructures, and, accordingly, other profitability of exports.

If a couple of years ago more than 65 companies exported grain, now there are a little more than 20 of them.

Data on current shipments in Russian ports, historical data on grain shipments since 2012 can be generated on the basis of the analytical platform Logistic OS.

The system consists of several modules: Line-up, Export Date, Ratings, Ports, Cargoes, Vessels, as well as a large number of reference books.

Users are given the opportunity to use various analytical tools and download data in the format Excel.

When there is a need to obtain comparative data in the form of ratings, then in the «Ratings» module it is necessary to select the country, type of cargo and the required time interval.

Follow the link to get free trial access for 1 month.

«Support of Russia» — an organization uniting representatives of small and medium-sized businesses, sent a proposal to the head of the Ministry of Agriculture to support exports through small ports of Russia, using a decreasing duty rate.

The duty can also be reduced for those exporters who carry grain by rail and by road.

And it is not only a duty to maintain a certain level of prices: it includes subsidies, loans, and tax incentives.

And all tools must be applied systematically so that the industry as a whole does not lose its competitiveness.