France’s longstanding dominance of the Algerian market could be shaken.

For a long time, Russian grain appeared on the Algerian market only occasionally. This was due, first of all, to the high phytosanitary requirements for grain imposed by the Algerian side.

In 2018, Algeria announced its intention to import wheat from Russia in order to prevent France from monopolizing the Algerian grain market.

Algeria is the first consumer of French wheat. The share of France in the Algerian grain market is 70%. And in some years this share was over 80%.

Each year, Algeria consumes up to 12 million tons of grain, and its own production covers only 30% of its own consumption.

The steadily increasing population (currently around 45 million) is also steadily increasing consumption.

Already, Algeria is the fifth in the world and the second in Africa buyer of wheat.

Until recently, high requirements for grain quality (permissible level of wheat damage by insects) made it impossible to export Russian wheat, although it was cheaper than French wheat.

Algeria’s lowering of grain quality requirements opened the way for Russian exporters to the Algerian market.

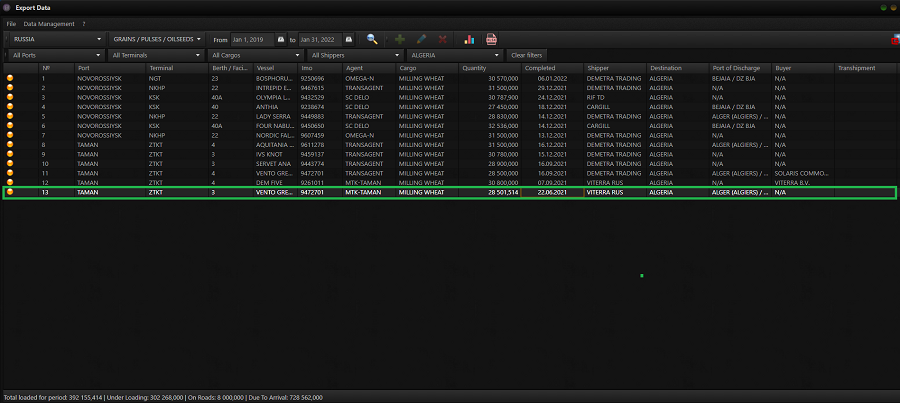

The pioneer in the Algerian market was Viterra Rus, which shipped 28.5 thousand tons of grain on June 22, 2021.

It is symbolic that this batch went abroad almost simultaneously with the refusal of Algeria to accept a batch of wheat from France of almost the same volume as unsuitable for food consumption after the bodies of two dead animals were found in the grain.

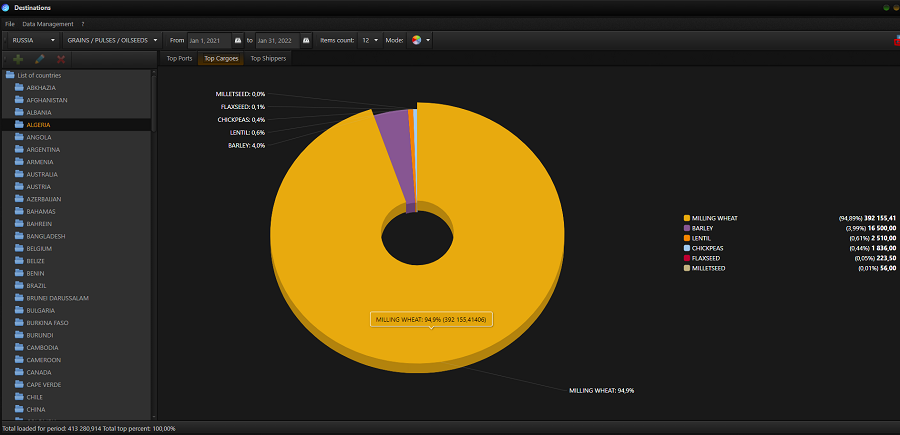

From the beginning of the year to the present, according to the analytical platform Logistic OS, Russia has exported 392 thousand tons of wheat to Algeria.

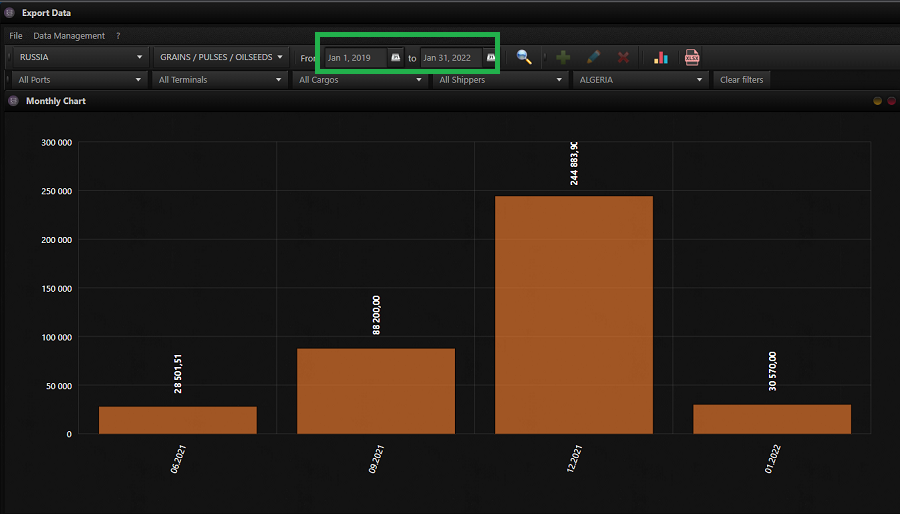

Dynamics of shipment of Russian wheat to Algeria by months:

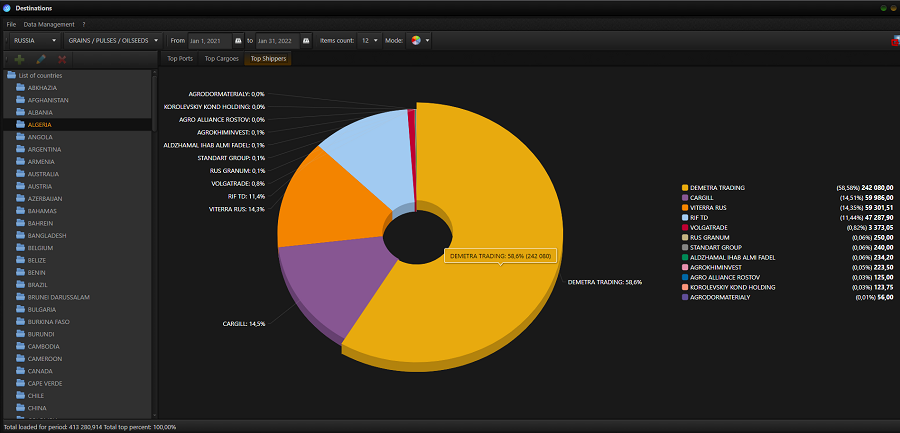

The absolute leader among Russian exporters in the supply of grain to Algeria is Demetra-Trading LLC, the largest vertically integrated grain holding in Russia.

The Algerian grain market is an annual turnover of billions of dollars, and not only Russia is fighting for this market.

In 2021, the trade turnover between Russia and Algeria increased by 2.5 times, amounting to about $350 million.

Data on current shipments in the ports of Russia, Ukraine, Bulgaria and Romania, historical data on shipments of grain since 2012 can be generated on the basis of the Logistic OS analytical platform.

The system consists of several modules: Line-up, Export Date, Ratings, Ports, Cargoes, Vessels, as well as a large number of directories.

Users are given the opportunity to use various analytical tools and export data in Excel format.

(click here for free trial access)