How does this indicator affect the pricing of commodity markets?

The issue of ensuring food security in the world and «global hunger» is increasingly on the agenda.

The current macroeconomic and political situation in the world is inevitably linked to the quotations of futures for raw materials and agricultural crops on world exchanges.

If we analyze the change in the value of key commodity futures over the past few months, the picture emerges as follows:

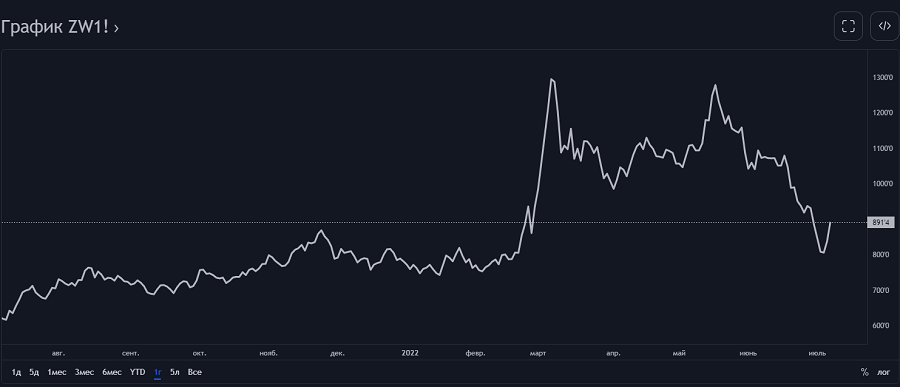

Wheat

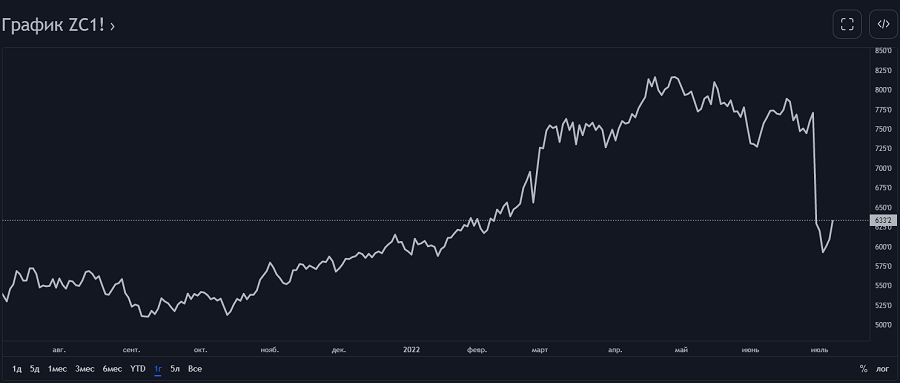

Corn

Soya

Comparing the dynamics of price changes for these futures, you can see that their movements practically repeat each other, but with different amplitude, which is associated primarily with the volatility and significance of a certain commodity group in world consumption.

July 5-6, 2022, wheat, corn and soybean price indices tested the lowest levels since March this year.

Exchange prices of commodity futures, such as oil and gold, also fell to their lowest levels from the peaks of March 2022.

June 15, 2022 A regular meeting of the Fed was held, at which there was another increase in the key rate by 75 basis points at once, after which a steady downward trend in prices for futures contracts for agricultural crops could be observed on the exchange.

Globally, this means that there is less money in the economy, it becomes more expensive, which forces stock speculators to reduce their positions and trading activity.

The detailed minutes of this meeting released on July 06, 2022 gave market participants reason to believe that the rate increase would continue, and the market tried to win back in advance a further change in the monetary policy of the US Federal Reserve System, as well as other major Central banks of the world.

Against the backdrop of the decisions made, the dollar index, which shows the value of the American currency against a basket of 6 major world settlement currencies (the euro, the British pound, the Canadian dollar, the Swiss franc, the Japanese yen and the Swedish krona), is growing, passing the maximum marks in its history.

The more expensive the dollar is relative to other currencies, the fewer dollars you need to buy commodities and agro-industrial goods.

As a result, they lose value in dollars.

But, given the current situation in the world, the picture is not so obvious: on the one hand, traditionally, the ratio of the cost of commodity futures and the dollar index are inversely correlated.

On the other hand, the euro is weakening against the background of the aggravated economic situation in Europe and high inflation.

At the moment, the exchange rate of the euro against the dollar shows the lowest values over the past 20 years, on the Moscow Exchange at the moment it reached parity.

Therefore, the current index of the dollar says not so much about the strengthening of the American currency, but that the United States partially shifts inflation within its country to a more significant increase in inflation in other countries that purchase large volumes of goods and raw materials.

The next Fed meeting will be held on July 27, 2022. Traders predict further rate hikes.