Egypt plans to enter the world commodity trading market, thereby ensuring the inflow of foreign capital into the country.

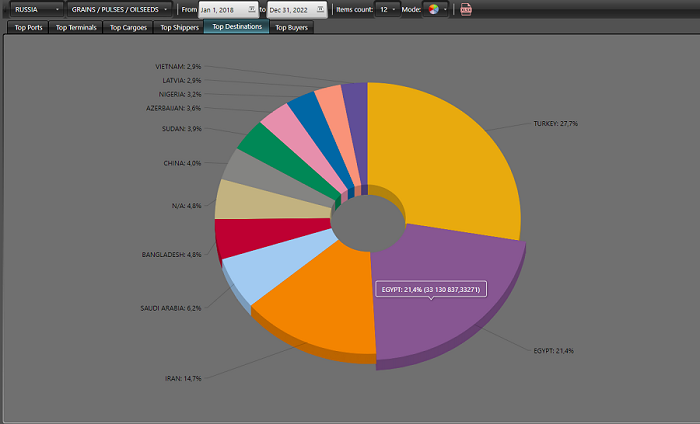

Over the past 5 years, Egypt has consistently been in the top three among importers of Russian wheat, second only to Turkey (according to the analytical platform Logistic OS).

According to preliminary estimates, in 2021-2022, the country imported more than 5 million tons of grain from Russia (16% of Russian exports, and for Egypt — 70% of grain imports).

17% of imported wheat was purchased by GASC (state importer of essential goods), the rest was imported by private companies.

But by September this year, the global political and economic situation led the Egyptian economy to a shortage of dollars, as a result of which private companies practically suspended grain imports from Russia.

An important factor was the complication of making payments between our two countries.

Sale of grain through the exchange EMX is a bypass channel SWIFT

The creation of the EMX exchange will provide an opportunity to remove private Egyptian companies from the risk of falling under secondary sanctions.

At the same time, this is an opportunity for the additional sale of rubles that Egypt receives, including from Russian tourists.

Russia, on the other hand, gets the opportunity to «run in» the transfer of foreign trade into rubles.

The mechanism for mutual settlements between buyers and sellers through the stock exchange has been agreed: the Russian government will lend rubles to the Egyptian side, and after the deal is concluded, the funds will go to Russian banks.

All settlements on the EMX exchange will take place through correspondent accounts of Russian banks.

Why does Egypt need its own commodity exchange?

Egyptian traders can conclude contracts for the purchase of wheat, including in rubles on their own.

According to experts, the creation of an exchange and the transfer of wheat to the category of exchange goods is an opportunity to smooth out price fluctuations and increase the transparency and efficiency of the domestic wheat market.

In addition, the Russian government plans to fix the amount of export duty for exchange transactions.

But it is likely that in the future the EMX exchange may become a hub for the sale of Russian wheat to African countries.

In the meantime, only one seller works on the stock exchange — the state company GASC, which puts grain from its stocks up for auction twice a week, and the auction resembles a closed auction.

In the future, the exchange plans that Russian companies exporting wheat will also appear on the site.