In 2020, Russia will harvest a record low crop over the past 17 years.

The history of this problem is rooted in 2016-2017, when, due to overproduction of buckwheat, the price fell to 5.5 thousand rubles per ton, while at its maximum in 2011 the price was 56 thousand rubles / ton.

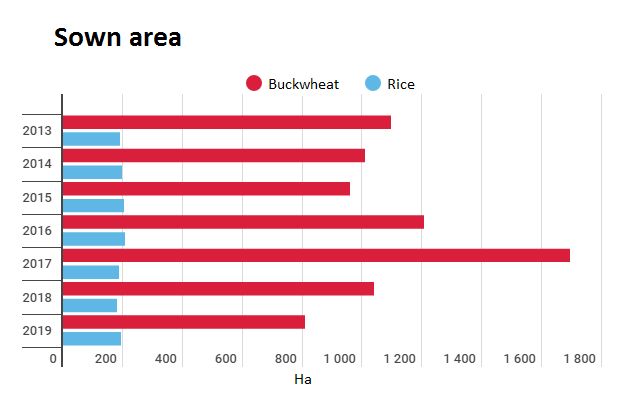

That is why in 2018, crops for this crop were reduced by 40% to 1,037 ha against 1.7 million ha in 2017, and continued to decline in 2019.

Even then, the Altai Union of Grain Processors predicted a fall in the price of buckwheat in 2019, and a possible increase only in 2020-2021.

Indeed, at the end of the summer of 2019, a ton of buckwheat cost 12-13 thousand rubles, and in the middle of this season the price went up sharply to 37 thousand rubles / t. And only now it has ceased a little fever, stopping at around 22-24 thousand rubles / t.

The forecasts of grain processors began to come true a little earlier under the influence of the coronovirus epidemic, when in March, against the background of excessive demand, buckwheat sales from March 16 to 22 amounted to 209% of the level of the previous week.

Against this background, in March wholesale prices for the final product almost doubled compared to March 2019.

At the same time, buckwheat began to rise in price.

Arid weather did not add optimism to the forecasts: in Altai the weather continues without rains, and there is no need to wait for a high harvest. But the Volga region and the Central Black Earth Region should come to the rescue, where the end of spring and the beginning of summer were met with rainy weather.

But the main problem lies, of course, in the reduction of sown areas.

This year, 732 thousand ha were sown with buckwheat in Russia. A year earlier, crops were 807 thousand ha.

The areas sown this year have become equal in terms of performance since 2003.

The graph shows how the sown area for the main consumer products changed.

In April 2020, after the booming demand for buckwheat and its final product, buckwheat, the first deputy minister of agriculture Dzhambulat Khatuov announced plans to increase crops by 50-70 thousand ha.

At the same time, the Ministry of Agriculture assured that there are enough carry-over in Russia: in April they were at the level of 300 thousand tons.

Therefore, a buckwheat deficit is not expected, especially since consumers have already made maximum stocks of this crop in March. But buckwheat in itself is not a product of primary need, and no one has canceled the norms of consumption by the population.

In general, the buckwheat market develops in cycles of 5-6 years. The fall in prices usually lasts two to three years. And even if during this period, farmers understand that crops need to be reduced, they cannot do this at the time of sowing: there are already plans for sowing all crops and purchased seeds.

Then the situation changes in the opposite direction: the price rises and grows for another two years. The increase in sown area begins.

But the so-called “wavelength” can be corrected by weather conditions: buckwheat needs heat and moisture, drought destroys it. Early snow and a hurricane, on the other hand, can break off spikelets, which also leads to crop losses.

While prices for buckwheat continue to fall, but their growth is most likely inevitable: Russia, for example, along with Kazakhstan and Belarus, supplies buckwheat to Ukraine, where this year the crop is also forecast at a historic low.

Therefore, in a more favorable situation will be those enterprises that make purchases at the beginning of the season.