Sunflower sowing, which ended in Russia, called into question the export of oil and fat products by $ 8.6 billion by 2024

The consequences of restricting sunflower exports and the planned increase in export duties have led to a decrease in sown areas.

According to the latest data from the Ministry of Agriculture, they amounted to 8.3 million hectares. And although it is 2.3% more than planned, it is 0.3 million ha less than last year.

The Commission on Customs and Tariff Regulation made a decision to increase the export duty on culture to 20%.

In addition, the ban on the export of sunflower from the EAEU was extended until August 31.

More precisely, a special permissive regime was introduced, but, in essence, this is the same prohibitive measure.

Such conditions will not only not become an incentive for manufacturers, but also negatively affect pricing.

Today, 89% of the industry is controlled by 9 large companies that consolidate their pricing policies based on achieving maximum profitability of their production.

The purpose of the restrictions imposed on the export of sunflower seeds was to create conditions in which oil-producing enterprises can increase their marginality by reducing prices.

But something went wrong and the result was the opposite: Turkey, being the largest importer from Russia, when import restrictions were imposed, began to purchase large quantities of sunflower oil instead of sunflower, thereby stimulating, initially, the increase in sunflower prices, and then to the final product.

The next message imposed by the restrictions was the desire to keep prices for consumers in the face of falling incomes.

But now the selling price for sunflower oil is higher than at the end of March by 8 thousand rubles.

And this despite the fact that directly sunflower added only 5.5 thousand rubles in price.

And the stability of retail prices is achieved by direct agreements with networks on the removal of trade margins.

But everyone understands that such containment is infinitely impossible, and something will finally press the trigger of the price increase.

Most of all in the situation with restrictive measures, the loss of confidence of farmers is worried.

They reduce the area under crops, which is beginning to have a stable export restriction. And this limitation seems to be becoming a long-term trend.

And here we must not forget that Ukraine continues to supply sunflower oil to the world market, and besides, it is Russia’s closest competitor.

And in this struggle, Russia is no longer in the lead: during the period April-June, our producers exported 117 thousand tons of oil, Ukrainian — 176 thousand tons.

In June, Russia exported a little over 8 thousand tons, while Ukraine shipped 60 thousand tons.

As in the situation with the export of wheat, the question of the loss of customers and share in the world market is acute.

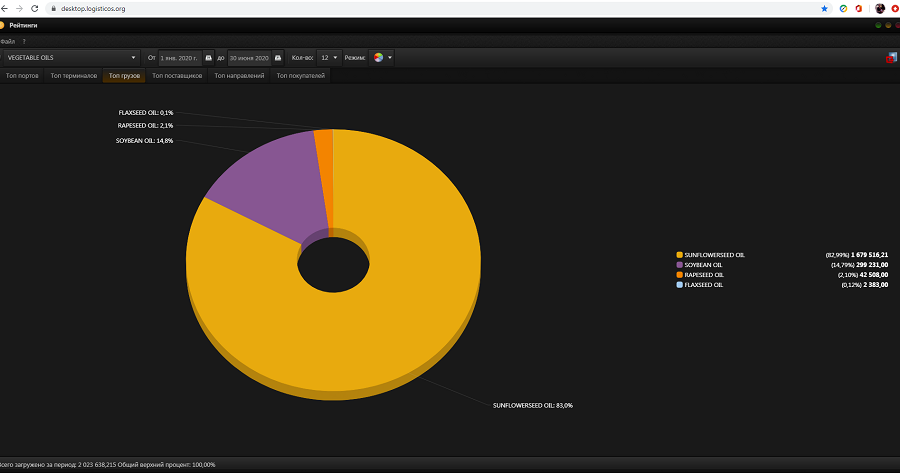

On the analytical platform Logistic OS in real time you can get data about the shipped cargo, the vessels under loading and ships on the way at all ports of Russia and Ukraine.

Also, registered users are available data on types of cargo, shippers, ports of destination.

The platform allows you to analyze information in various slices, using a convenient interface for filtering and selecting data.