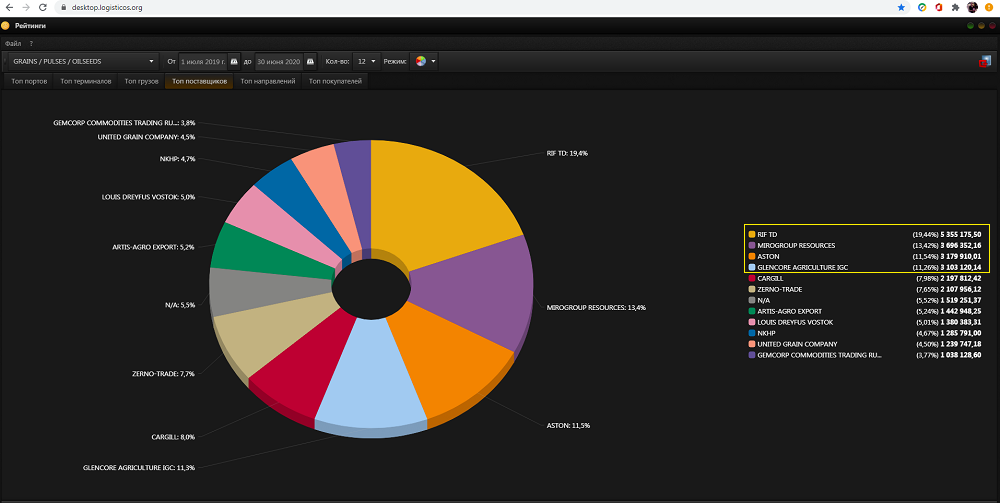

According to the Logistic OS platform, which is also confirmed by other official sources, 76.4% of the total export in the 2019/20 season was accounted for by the 20 largest exporters.

In total, 20 companies included in the TOP suppliers shipped 31.2 million tons of grain, not including supplies to the EAEU countries.

TOP-10 exported 25.8 million tons, which amounted to 63% of the total cargo. Compared to the season 2018/2019, the increase was 6%.

Over the course of five years, has been at the top of the Reef TD rating , registered in the Rostov Region with an export volume of 5.3 million tons.

For the first time, TOPst 3 entered the company Mirogroup Resource , which is part of the Demeter Holding, created by VTB. She showed the second result with a volume of 3.7 million tons.

In general, the market is very attentive and with some apprehension monitors activity on the VTB grain market: the company is expanding its network of terminals and is actively developing its trading activities. Exporters fear that this will affect access to port terminals and rail.

In third place is Aston . The export volume of this company amounted to 2.95 million tons.

Glencore lost its position a little and with a volume of 2.91 million tons fell to fourth place.

TOP-5 of the largest exporters closes OZK (2.6 million tons).

Undoubtedly, according to experts, the 2019/20 season was quite difficult.

The first half did not bring profit to exporters, and some suffered losses. And only the second half of it allowed to make a small profit.

The most significant impact on the grain market was the introduction of export quotas.

Hundreds of thousands of tons of products could not be exported abroad. And this, in turn, increased the risks of both agricultural producers and traders.

Quoting had an important effect on buyers who are now not sure of the stability of supplies from Russia.

If now exporters from other countries with more transparent export schemes are most active, it will be much more difficult for Russian exporters to sign future contracts.

At the same time, experts believe that quotas, which in fact are manual controls, dealt a serious blow to market participants: large companies suffer losses, and small and unstable ones simply go bankrupt.

And it did not have any effect on the price level, agrarians believe: price growth would be at the same level and a decrease in shipments would still be observed due to their growth.

But, despite the recommendations of exporters, the Ministry of Agriculture confirmed that quotas are introduced in Russia on an ongoing basis. It will not operate in the first half of the agricultural year; possible restrictions will be introduced in the second.