In June, sunflower and rapeseed sales prices reached record highs.

Despite the export ban from April 12 to June 30, 2020, sunflower prices have continued to rise for four months in a row.

On average, according to Rosstat, in June the price of sunflower increased to 22.413 thousand rubles. per ton.

If we compare these figures with May 2020, then the increase was 6%, and compared with June 2019 — by 18%.

The average price of rapeseed rose to 26.953 thousand rubles. per tonne, which corresponds to an increase to May 2020. and June 2019. + 5% and + 21%, respectively.

This year, according to analysts’ forecasts, the sunflower harvest will amount to 14.6 million tons, soybeans — 4.7 million tons, rapeseed — 1.8 million tons.

The Oil and Fat Union assumes the harvest of sunflower and soybeans at the level of the last year, if weather conditions do not make their own adjustments.

This year, 8.5 million hectares are occupied by sunflower, which is 0.3% less than in 2019.

Soybean plantings decreased by 6.8%, rapeseed — by 4.4%.

At the same time, sunflower prices by the beginning of July (compared to the last week of June) increased by 411 rubles per ton, the highest rise in price was in the Krasnodar Territory and the Tambov Region.

The price of sunflower oil has been growing steadily since March 2020 due to the growth of export quotations amid the devaluation of the ruble.

The main country that pushed the increase in quotations was Turkey, which was forced to switch to other suppliers in connection with the closure of sunflower exports from Russia.

At the beginning of July, the current oil price was 30% higher than last year.

The active rise in prices has been suspended so far, this is associated with an increase in oil prices, good demand for meal and a relatively small amount of raw materials.

In any case, prices for oilseeds at the start of sales will be higher than last year.

During the season, there will certainly be a decline, but they will not drop to the level of the 2019 harvesting company.

Therefore, market experts do not recommend that manufacturers hold on to the product, but sell it at the start of the season.

From July 1 to August 31, 2020, the EAEU operates a permitting export regime for sunflower oil, which exporters compare with the quota regime in its essence.

The regime provides that the customs authority will be provided with permits for the import, export and transit of goods.

According to analysts, it is not yet very clear how this regime will work, but there are chances to export sunflower seeds.

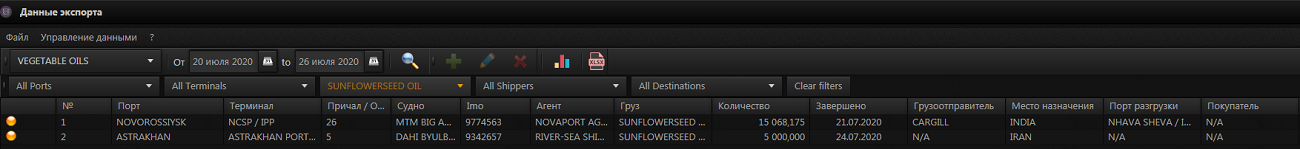

Last week, according to the analytical platform Logistic OS , 15.1 thousand tons were shipped through the Novorossiysk port vegetable oil to India, and through Astrakhan — 5.0 thousand tons to Iran.

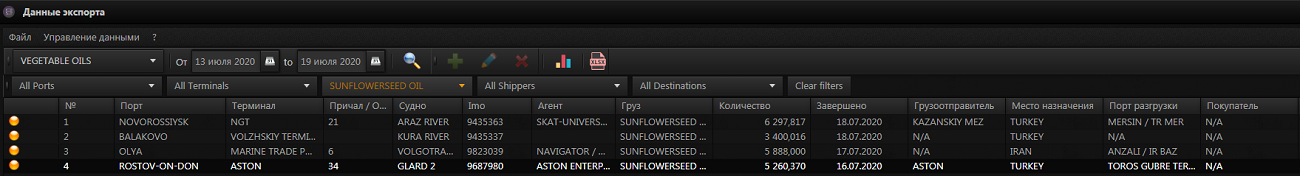

A week earlier, another 20.8 thousand tons of oil went to Iran and Turkey.

At the moment, producers and exporters need certainty about what will happen with the export of sunflower so that they can make plans for crops for the next year.

And whether the export duty will be increased from 6.5% to 20%.

20% duty on sunflower export existed from 1999 to 2013. During this period, there was practically no export — in 1999, only 31 thousand tons of oil were exported.

Then, after 2013, a phased reduction of the duty followed, which allowed to increase the yield by 4 times over the years, the processing capacity by 5 times, and to bring the export of sunflower seeds from scratch to a leading position in the world market.

According to experts, the demand for a product is dictated not by exports, but by strong internal processing. And the protective measure for export is a tool to stimulate the internal processing, the further development of agriculture in the country and large earnings of agricultural producers.