Experts have raised the forecast for wheat harvest immediately by 3.5 million tons to 81 million tons.

Optimistic data come from the fields of the Central Region: a record harvest will be harvested for winter wheat.

Despite the fact that the South of Russia, due to difficult weather conditions, did not reach the level of harvesting to last year’s indicators, in total, very high figures are expected in Russia — the second after the record 2017.

On average, wheat yield is forecasted at 27.5 centners per hectare. In 2019, this figure was 26.5 centners per hectare.

This year, farmers have sown 29.4 million hectares of wheat — an increase of 4.6%.

The South of Russia and the North Caucasian District have practically finished cleaning. The forecast has been raised to 29.3 million tons, but 2.4 million tons are behind the previous year.

In the Central region, the last rains allowed to form a record moisture reserve in the soil, which increased the forecast for grain harvest by 1.3 million tons to 22.8 million tons, adding 5.5 to last year million tons.

The forecast for the Volga Federal District has also been increased by 1.3 million tons to 17.5 million tons — plus 6 million tons by 2019.

Harvesting has just begun in the Urals, but a good start made it possible for experts to assume that the bar will be exceeded at 3.1 million tons — an increase of 0.5 million tons.

In the Siberian region, the forecast remains the same — 7.5 million tons (“minus” 1.8 million tons from last year’s level).

Such a high harvest will not give producers the opportunity to raise the price of grain: analysts predict the price of wheat in the current season at around $200 per ton.

At the same time, the wheat export forecast has grown: the approximate figures fluctuate in the region of 36.5 — 38 million tons. In the 2019/20 season, this figure was 35 million tons.

The International Grains Council (IGC) assumes the export potential of Russia at 37.1 million tons.

The introduction of the quota last season has seriously reduced the number of exporters and reduced competition.

This is extremely disadvantageous for agricultural producers: a situation is quite likely when, due to the lack of demand from different customers, they will have to agree to the price they offer, otherwise there will be simply no one to sell.

Market participants believe that the introduction of a quota is not a measure of market regulation, but an attempt to control it, which will have very serious long-term consequences.

It is already obvious that some of the importers are switching to other export markets, solving the problem of concluding contracts with stable shipping suppliers.

This allowed, for example, Ukraine, our longtime competitor in the wheat market, to conclude such agreements.

An indicative situation was with the Republic of Bangladesh, which increased several times the volume of purchases from Ukraine, thereby reducing supplies from Russia.

It is not yet clear how much Russia will be able to increase supplies to Lebanon after the explosion in Beirut, which destroyed a strategic grain storage.

This explosion did not directly affect Russian exporters, but so far the consequences are not clear.

About 60% of grain purchases passed through the destroyed terminal, and now the Lebanese government urgently needs to resolve the issue of logistics — where the cargo will be unloaded.

Now unloading operations are carried out in Tripol, the country’s second most important port, but there are no granaries there, and now wheat reserves in Lebanon are left for 1 month.

This season, against the background of a decrease in the harvest from our Black Sea neighbors, Russia planned to increase supplies to Lebanon, which were decreasing year by year: last year, only 176 thousand tons were exported due to high competition with countries EU and Ukraine.

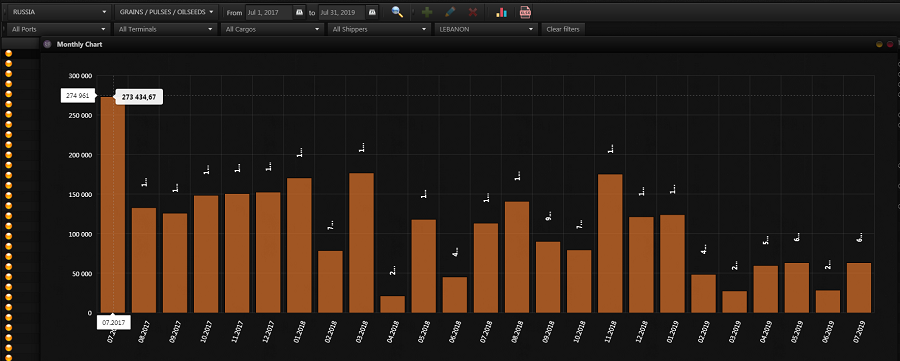

Although, back in 2018, Russia shipped 768 thousand tons to Lebanon, and a year earlier — 1 million tons.

The delivery decline schedule from July 2017 to August 2019 is very clearly visible on the analytical platform Logistic OS :

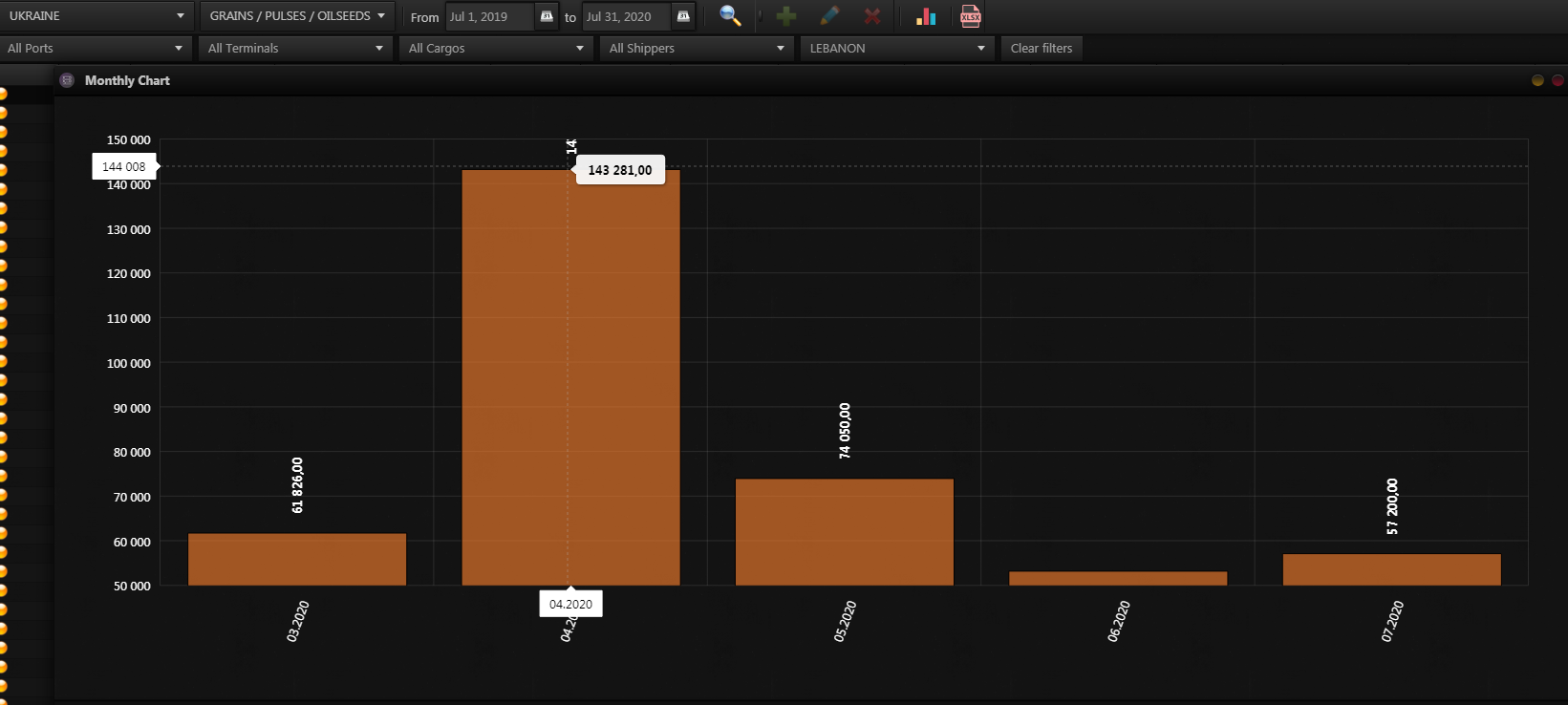

On the platform Logistic OS , it became possible to receive analytical data on export shipments from Ukraine.

So only from March to July 2020, Ukraine has already supplied 389 657 tons of wheat to Lebanon.

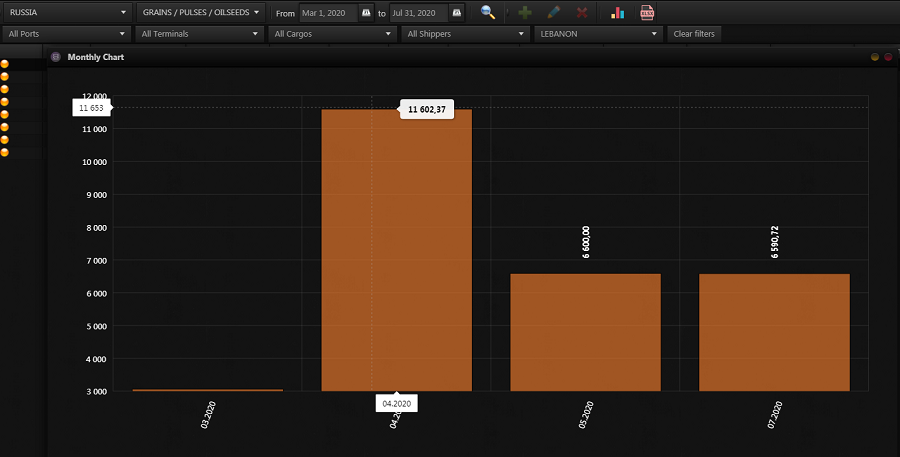

And Russia for the same period only 27,863 tons.

It is not yet clear to what extent Russia will be able to increase exports to Lebanon, but, unfortunately, there is a tendency for a part of exports to go to our sister in the Soviet Union.