The demand for imports of grain crops is constantly growing, and their high-quality transportation is becoming increasingly important.

The bulk of such cargo is transported by sea. Therefore, the food security of the country and the future prospects of the agricultural region depend on how this segment is developing, how the construction of port terminals is proceeding.

The Russian government has made port development a national priority.

But what is interesting in this regard: the construction and reconstruction of ports is carried out not by the government, but by private investors.

More details about the structure of some ports in the south of Russia and upcoming projects.

Azov-Black Sea region

One of the largest ports on the Black Sea coast is located here — the Novorossiysk port.

Oil products, oil and coal, petroleum coke and ferrous metals remain strategic cargo for the Novorossiysk port until 2024.

In this area, the development of terminals is carried out by Transneft, which plans to invest 108.4 billion rubles in the reconstruction by 2029, and about 45 billion will be invested in new projects: this is a container terminal, a mineral fertilizer terminal, a terminal vegetable oils.

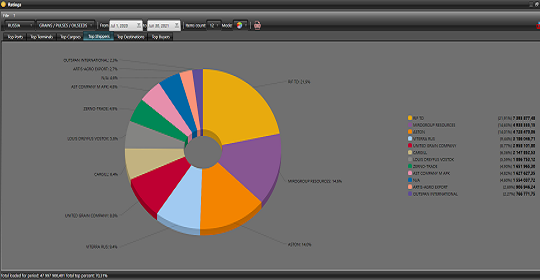

If we talk about the grain market, then on the territory of the Novorossiysk port the leading companies that transship this type of cargo are JSC KSK (part of the Delo group), the Novorossiysk Combine of Grain Products (NKHP) and the Novorossiysk Grain Terminal (NZT).

The project for the reconstruction of the KSK grain terminal, which just recently passed a check on the determination of the estimated cost, provides for an increase in the terminal’s cargo turnover, which now amounts to 2.5 million tons per year, to 4 million tons per year.

The amount of investments within the project will be about $ 68 million.

In turn, United Grain Company (UGC) based on NKHP and NZT (some of whose assets, to a greater or lesser extent, belong to VTB Bank , as well as part of OZK’s assets) plans to create a «United Grain Terminal».

This mega-project will allow to increase the total grain handling capacity from 13.1 million tons to 25 million tons by 2024.

The group of companies TBI, which provides a complete logistics chain for the delivery of goods in the port of Novorossiysk, is also actively developing its own projects, in particular the launch of a new container terminal (read a detailed interview with Ivan Dmitrievich Karamanov, General Director of TBI LLC).

One of the projects of the TBI GC is the analytical platform Logistic OS, which allows users to analyze the situation in the ports of Russia and Ukraine in real time.

Crimea

The State Unitary Enterprise of the Republic of Kazakhstan «Crimean Sea Ports» unites seven branches: the trade ports of Kerch, Yalta, Feodosia, Evpatoria, the Kerch fishing port, the Kerch ferry crossing and the State Hydrographic Service.

The ports of Crimea have been hit hardest by the EU sanctions and the commissioning of the Crimean bridge and are suffering losses.

Although there are already several private investors who are interested in the reconstruction of ports (there is no official information yet).

In the future, the ports of Crimea can become a transit point for trade with the Middle East, in particular, with Syria.

Taman

In 2019, the Taman terminal was launched here — the largest bulk cargo terminal at the port of Taman.

According to plans, by 2021 the volume of cargo transshipment will reach 60 million tons.

Shipments from here are possible to the countries of the Middle East, South Europe, Asia and America.

To eliminate the shortage of port facilities, it was planned to implement a project to create a dry cargo area in the port of Taman.

But, according to the latest information, the Russian government plans to exclude this project from the comprehensive plan for the modernization of infrastructure.

According to the available data, this is due to the fact that the project became uninteresting to prospective investors due to the fall in coal prices.

Instead, it is planned to include a project for a grain terminal in the seaport of Taman by Agroholding-Taman.

The project cost is estimated at 32.5 billion rubles.

At the moment, Taman Grain Terminal Complex LLC operates on the port territory.

The big problem facing the development of the infrastructure of the ports of Russia is the failure of investors to fulfill their obligations.

In this regard, the Russian Government has published a draft federal law obliging to consolidate the obligations of investors at the legal level.

If the project is accepted, the investor will be obliged to provide cash, bank guarantee or sureties as a guarantee.

In case of early termination of the agreement due to a significant violation of it by the investor (failure to meet the deadline, insufficient investment), the costs incurred by them are not reimbursed.