Wheat prices have suspended their multi-day growth.

Last week the price of wheat with 12.5% protein for December delivery reached $ 250-251 / t FOB, down $ 7.5.

Those who want to buy put the price at $ 248 per ton, and those who want to sell — $ 253-254 per ton, while Russian wheat is still $ 3-5 more expensive than its competitors.

Against the background of a decrease in export prices, purchase prices in deep-water ports also went down, having lost 400 rubles, to 18.4-18.6 thousand rubles. per ton.

It should be noted that the number of proposals is not so great: farmers are holding back the harvest, although the current price is 46% higher than last year.

Producers have enough storage capacity: a low sunflower harvest has freed up warehouses.

At the same time, the schedule of delivery to deep-water ports by rail is fully scheduled for November, distribution is in progress for December.

A slowdown in the price movement upward and some stabilization were expected, because the level that had been established before that reduced its competitiveness.

The past GASC tender showed that a drop in export prices is not expected until mid-January. The rest depends on the ruble exchange rate and on the state policy in the field of regulating sales abroad.

Meanwhile, at the last tender, held on November 5, Egypt bought 300,000 tons of Russian wheat cheaper than in October.

Wheat purchased with two delivery dates: December 15-30, 2020 and January 08-18, 2021.

Most of the grain was purchased at $ 261.30 per tonne FOB with a freight rate of $ 14 per tonne. Total $ 275.30 per tonne C&F.

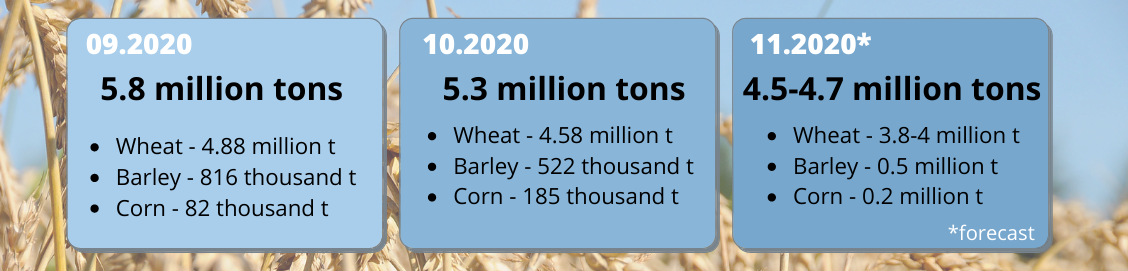

According to analysts, Russian grain exports in November 2020 will amount to 4.5-4.7 million tons. Of these, 3.8-4 million tons of wheat, 0.5 million tons of barley, 0.2 million tons of corn.

The volume of October exports was slightly higher than analysts’ forecasts, although it decreased compared to September volumes: 5.3 million tons versus 5.8 million tons.

Wheat shipped 4.58 million tons (September 4.88 million tons).

Barley exported 522 thousand tons (September 816 thousand tons).

185 thousand tons of corn sold to foreign markets (September 82 thousand tons).

According to preliminary estimates, by the end of this year, Russian wheat sellers will realize 60-65% of their export potential.

At the same time, the volume of shipments will be higher than last year.

A reduction in the supply of sufficient quantities of wheat to foreign markets by the EU and Ukraine led to a significant increase in Russian exports: in July-October, 17.5 million tons of wheat were shipped — an increase of 8.7%.

If we compare the shipments of the end of the year, then in 2019, 2.7 million tons were sold abroad in November, and 2.5 million tons in December 2019.

This year, these figures will be approximately 4 million tons and 3.5 million tons, respectively.