The introduction of export duties on grain by the Russian Government has spurred price increases on both the international and domestic markets.

The decree provides for the establishment of a quota for the export of basic grain crops in the amount of 17.5 million tons from February 15 to June 30, 2021 and the establishment of a duty on this volume in the amount of 25 euros per ton. Anything that is exported in excess of the quota will be subject to a duty of 50% of the cost, but not less than 100 euros per ton.

By introducing an export duty on grain, the ministries hoped that this would reduce the desire of exporters to sell and importers to buy wheat.

And in the future, such a measure should stimulate the stabilization of prices in the domestic market — citizens began to resent the rise in prices for socially significant food products.

But exactly the opposite happened: during the week, world prices for wheat have grown so much that it is profitable to export grain, even taking into account the duty.

Since December, the price of wheat has risen by $ 15-20. The price of Russian grain has risen to $ 278. Exporters are adding about $ 30 duty to the price and increasing shipments abroad.

For comparison:

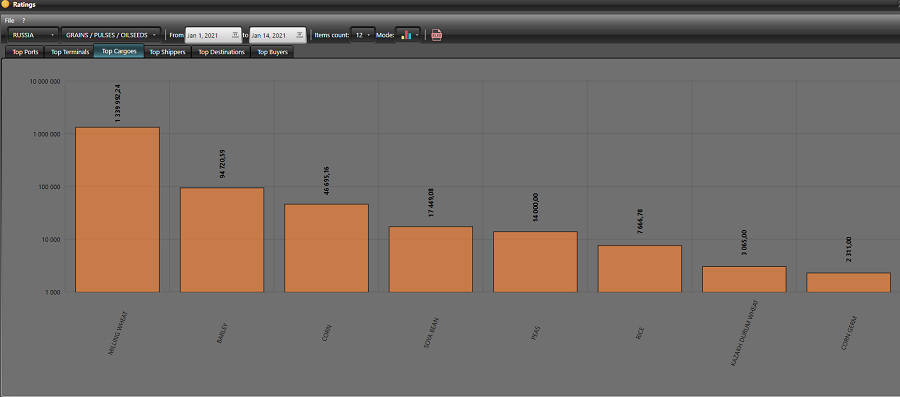

December 2019 — 2 778 thousand tons of wheat exported. January 1-14, 2020 . — 431 thousand tons .

December 2020 — exported 3 176 thousand tons of wheat . January 1-14, 2021 — 1 342 thousand tons .

Following the rise in world prices, the domestic market began to move, pulling itself up to this level.

When the decree on the introduction of export duties was still being discussed, market analysts warned that such a measure would not only not bring the desired result, but would lead to a worsening of the situation on the domestic market.

Analyzing the experience of such restrictions in 2010 and 2015, we can confidently speak about its inefficiency.

Not only the introduction of protective measures, but even their promise spurs the world market to higher prices.

Domestic prices may be lower, but this does not mean that they will stop growing: in 2010, after the imposition of the embargo on the export of wheat, prices inside the country grew faster than in the world.

What further stimulates exports is the fall in the ruble exchange rate. Even with the stagnation of world prices in dollars, it is more profitable to export products.

Seeing how the world market reacts to the introduction of export duties by Russia, the subcommittee of the Ministry of Economic Development is preparing to consider the possibility of an even larger increase — up to 50 euros per tonne within the quota.

Where will this lead?

In fact, this is practically a cessation of wheat exports, which will stop at 30 million tons, and the remaining 10 million tons will «fall» on the domestic market, which is unlikely to lead to an increase in production.

And most importantly, this will not solve the problem of domestic prices, because Russia is the leader in wheat exports in the world market and the market will adjust.

In addition, such fluctuations in the market can lead to a decrease in incentives for production, a decrease in acreage and purchases of fertilizers and agricultural machinery.

Another issue is that the ministry does not competently use another mechanism for regulating prices in the domestic market — procurement and commodity interventions.

By order of the government, up to 1 million tons of wheat and feed barley can be sold from the intervention fund in 2020-2021.

And trading will be restored on January 21, 22 and 23 on the Moscow Exchange.

But the problem is that after the end of the interventions on August 6, 2020, only 380 thousand tons of grain remained in the fund …

Purchases from this fund can be made not only by millers, livestock breeders and feed mills, but also by exporters.

The state agent for the grain management of the state fund is the United Grain Company (UGC).