The Board of Directors of NCSP approved the payment of dividends to shareholders.

NCSP Group is one of the TOP-3 port operators in Europe and the leading port in the Russian market in terms of cargo turnover.

The group includes two largest Russian ports: Novorossiysk in the South of Russia and Primorsk on the Baltic Sea, as well as the port of Bataysk in the Kaliningrad region.

The company accounts for 23.8% of the cargo turnover of all ports of the Azov-Black Sea basin.

The port of Novorossiysk is a key operator for export shipments of wheat, while the volume of shipments of the most important agricultural crop is constantly growing.

Also, barley and corn are shipped through the port with a constant increase in turnover.

The company’s role as a leading operator in the grain export market, including its financial performance and asset stability for investors, is always in the focus of attention of participants in both the grain and financial markets.

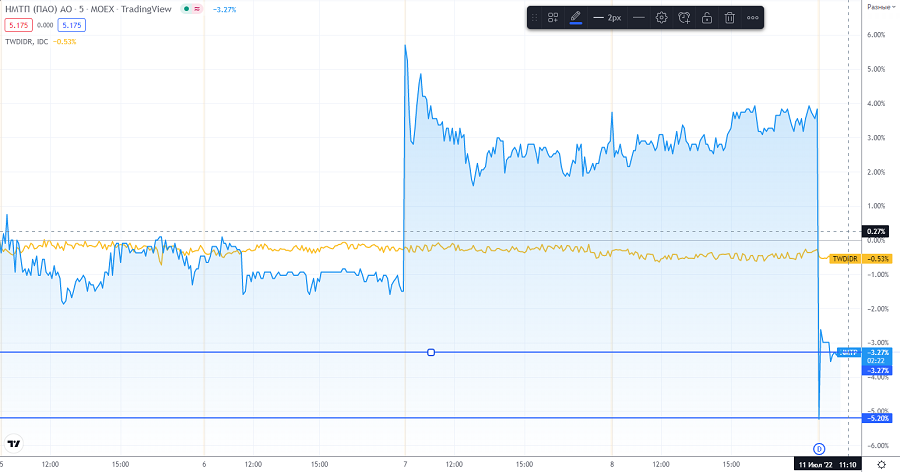

On the news of the planned payment of dividends to NMPT shareholders in the amount of 0.54 rubles. per share, the share price on the last day before the dividend cutoff (July 7, 2022), the asset showed an expected increase of 7.18%.

The total amount of payments amounted to 10.4 billion rubles.

At the opening of trading on July 11, 2022, the value of NCSP shares fell by 9.11%, but gradually added 2%, almost winning back the dividend gap.

As a result, the dividend yield of NMPT shares may reach about 9.7% per annum

Confirmation of dividend payment on NCSP shares is, among other things, positive for Transneft shares, for which NCSP cash flows are an impressive source of funds for paying its own dividends.

In turn, the Board of Directors of Transneft on June 29 recommended the payment of dividends in the amount of 10497.36 rubles. per one ordinary and one preferred share.

Considering this figure and current quotes, we can assume a dividend yield in the region of 8.55%.

At today’s prices, this is the highest profitability in the history of the company.

The situation of the last month on the dividend securities market remains quite volatile.

After a not-so-pleasant day for Gazprom shareholders about actually redistributing high profits away from dividends (following preliminary news that incredibly high payouts are expected), as a result of which shareholders were left without expected returns, special attention is paid to those companies that have confirmed their dividend policy.