According to experts, the volume of wheat exports abroad may fall to about 1.1 million tons in June.

Wheat exports from Russia are currently falling. For example, according to the latest forecasts, they may amount to about 1.1 million tons in June. This is several times less than in June last year, when this figure was 4.6 million tons.

But if we compare it with June 2022, the situation is similar: 1.2 million tons of wheat were exported from Russia in June three years ago.

At the same time, the figures for May are not great either. This year, May wheat exports amounted to 2.16 million tons. A year ago, in May it was twice as much: 5.06 million tons.

Thus, we are seeing a significant reduction in wheat supply volumes.

Analysts explain this by two factors at once.

Firstly, supplies are decreasing in general, since the export quota for the current year is significantly less than the previous one.

Secondly, world grain prices, including wheat, are currently quite low. This greatly reduces the motivation of farmers to supply abroad.

If you look at a larger scale, the decline in export rates is confirmed.

For example, from the beginning of the season to May inclusive this year, Russia exported about 41 million tons of wheat. This is extremely little compared to last year’s figure, which was 51 million tons.

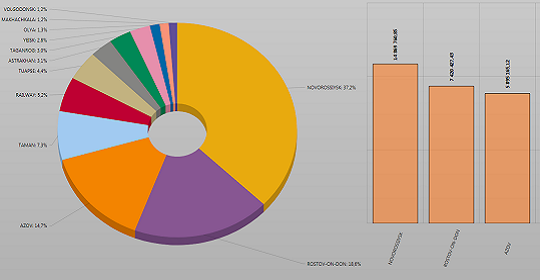

Currently, the main buyers of Russian wheat are the following countries: Egypt, Turkey, Bangladesh, Algeria, Libya.

At the same time, prices for Russian wheat have remained virtually unchanged lately, which casts doubt on exporters’ hopes for growth.

For example, the cost of June deliveries is about $227 per ton.

At the same time, wheat from other producers is gradually becoming more expensive. For example, French wheat has added $1 and is now trading at $228 per ton. Romanian rose by 3 dollars, also to 228, American soared in price by 4 dollars at once, to 226 dollars per ton.

As a result, we see that the gap between products from different suppliers is decreasing. At the same time, products from Russia no longer look more expensive compared to competitors, which can be considered a big plus for suppliers from the Russian Federation.

In general, analysts believe that the export campaign of the current season may end at minimum values. Forecasts for June were initially low, but some agencies are even reducing them.

Farmers and exporters place their main hopes on the next season. If the harvest is good, then there is every chance that export volumes will also increase.