The Ministry of Agriculture considered the experiment with the grain export quota successful and decided to make it permanent.

For half a year now, grain producers and exporters have been “fighting” with the state machine, arguing that there is no need for constant quotas.

The history of the discussion of this issue begins in January 2020, when the Ministry of Agriculture announced its plans to conduct such an experiment.

Then the officials explained this by the need to use various mechanisms to restrict exports from Russia, if certain conditions are met .

The main priority is the needs of the domestic market and the tasks of the country’s food security.

Separately, it was emphasized that the mechanisms under consideration will be used only when absolutely necessary , regulating the ban on exports exceeding a certain limit of Russia’s overall export opportunities.

Back in January, the Russian Grain Union (RGU) expressed its concerns to the Ministry of Economic Development and Trade that export restrictions would primarily hit producers.

They will not have a clear opportunity to plan business processes, which with a good harvest can lead to an increase in supply and a drop in prices.

As a result, the income of agricultural producers may fall. The consequence of this will be a decrease in investment in the agricultural sector, and in the future, a decrease in the possibility of increasing the production and export of grain.

The growth in demand will entail an increase in prices in the domestic market and a decrease in the competitiveness of Russian grain in the foreign market and may reduce the volume of exports below the determined quota.

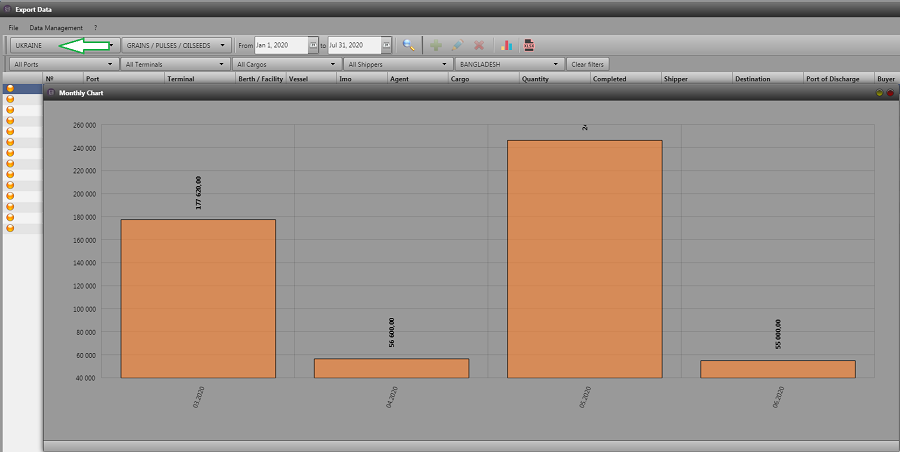

Back in January 2020, the Minister of Agriculture of Bangladesh announced that he would increase purchases of wheat from Ukraine if Russia introduced quotas.

The analytical platform Logistic OS provides access to data on export to international markets, including the export of Ukraine.

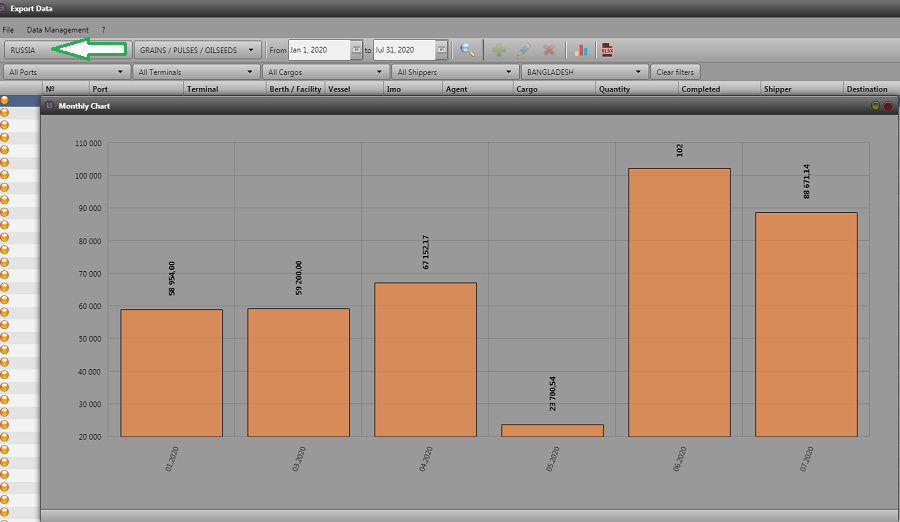

According to the platform, from January 1, 2020. until July 31, 2020 Russia exported 399,922 tons to Bangladesh, and Ukraine 535,750 tons .

Although during the same period last year, Bangladesh shipped Russian wheat 839,124 tons .

Also, quotas are contrary to the principles of transparency and clarity for all market participants.

In April-May 2020, the forecast of the information and analytical department of the Russian Grain Union came true: after the introduction of restrictive measures, massive chaotic grain shipments began, because exporters tried to manage to export as much as possible.

Over 800 thousand tons were unnecessarily exported.

And there is nothing to be surprised at: a simple market economy works — if they say that the goods will be issued with restrictions, then a queue will stand behind it and begin to buy for future use.

Demand increased because exporters began to buy grain in reserve, stimulating additional export volumes instead of restraining.

Seeing the rush demand, the farmers began to raise prices, and sometimes traders had to work at a loss in order not to disrupt contracts.

And the very issue of quotas was dishonest: at first, according to applications, who declared how much, but the criteria for selecting applications were not clear.

When they were all chosen, the remaining 870 thousand tons were put up for auction, which few people knew about. Therefore, the one who knew bought it.

As a result of all that happened, in June and July, exports were sluggish — exporters fulfilled winter contracts and were in no hurry to buy expensive grain of the new crop: by the beginning of the season, the remaining wheat amounted to 3.72 million tons , which is almost 42 % less than in the same period last year.

The smallest remainder was in the southern regions.

In addition, most of the intervention fund was sold — over 1.5 million tons .

After analyzing the results of the experiment with quotas, the Ministry of Agriculture did not abandon it, but, on the contrary, introduced it on an ongoing basis, somewhat changing the principle: now restrictions will be introduced in a targeted manner, as is the case in the fishing industry.

But many agricultural producers did not get access to export contracts in the spring due to their lack of transparency. How will quotas affect them this season?

In fact, purchases for the intervention fund will also remain, it will simply be renamed the stabilization fund and the harvest will be purchased at a price below the market price. This is a normal world practice with only one «but»: it gives the right to buy out grain at the same price, but this does not happen in our country.

Market participants are unanimous in the opinion that quotas and interventions are yesterday, and the market needs a major transformation with a transition to digital platforms where there are no intermediaries, and the farmer himself will be able to sell grain even abroad. Then the pricing will take place according to understandable laws, and in case of a global imbalance, exchange methods can be applied: stopping trading, etc.